Protection begins even before birth

Welcome to motherhood!

We know that there’s nothing you wouldn’t do to ensure your precious little ones' health, even before you lay eyes on them.

Let us be a part of your journey, protecting you and your child with PRUMy Child Plus, an insurance solution that uses PRUWith You Plus as the base plan to provide comprehensive protection for pregnant mothers and babies from 13 weeks of pregnancy and continues to cover your child until the age of 100. Because this is what love looks like.

Download the flyer here.

Continue to protect your child up to age of 100

If you’re an expecting parent, our Mom and Baby Care prenatal plan can help to protect the health and financial needs for both mother and baby altogether, should any complication arise.

ELITE PLAN

There are 2 other plans available for Mom and Baby Care.

Please speak to your Prudential Wealth Planner for more info.

Learn more about pregnancy insurance in Malaysia and how it can protect you and your baby.

Protection from 13 weeks of pregnancy

FAQ

What is PRUMy Child Plus?

PRUMy Child Plus is a comprehensive prenatal insurance solution that covers pregnant mothers and babies from 13 weeks of pregnancy until the child turns 100. It provides pregnancy coverage, and medical coverage so that you don’t have to worry about your finances should any complication arise.

How does it differ from other child insurance plans?

PRUMy Child Plus uses PRUWith You Plus as its base plan, which provides additional protection for pregnant mothers and babies.

Does PRUMy Child Plus only cover children?

PRUMy Child Plus provides coverage for pregnant mothers and babies as early as 13 weeks of pregnancy and continue to protect the child until the age of 100.

Are there any exclusions in the coverage?

As with all insurance policies, there may be exclusions to the coverage, depending on factors such as medical history. The best way to find out about exclusions is to talk to our Wealth Planners or refer to the policy document.

What is covered under maternity insurance?

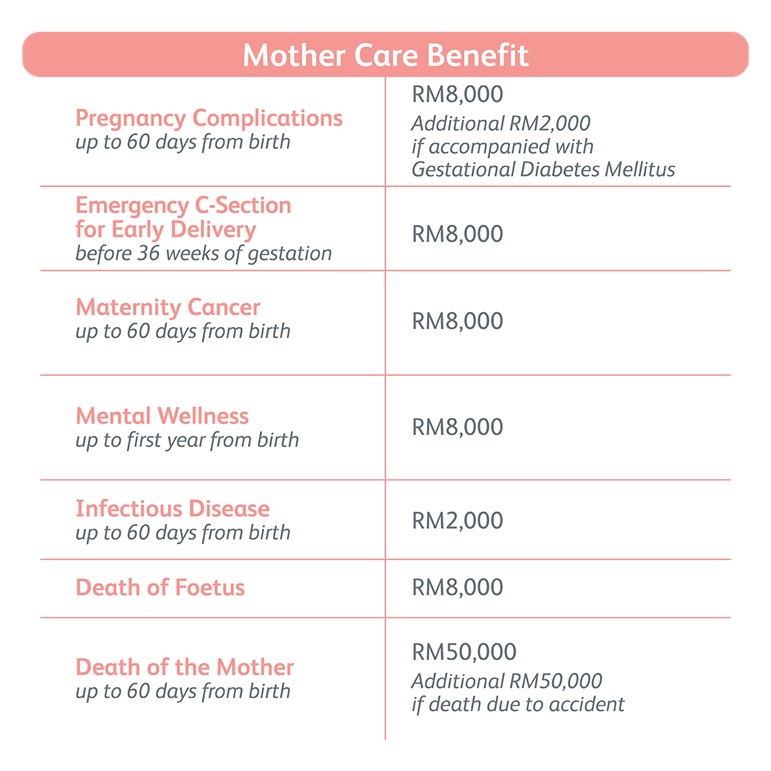

Prudential’s maternity insurance covers the expectant mother financially for the following:

-

Pregnancy complications

-

Emergency C-section for early delivery

-

Maternity cancer

-

Mental wellness

-

Infectious disease

-

Death of foetus

-

Death of mother

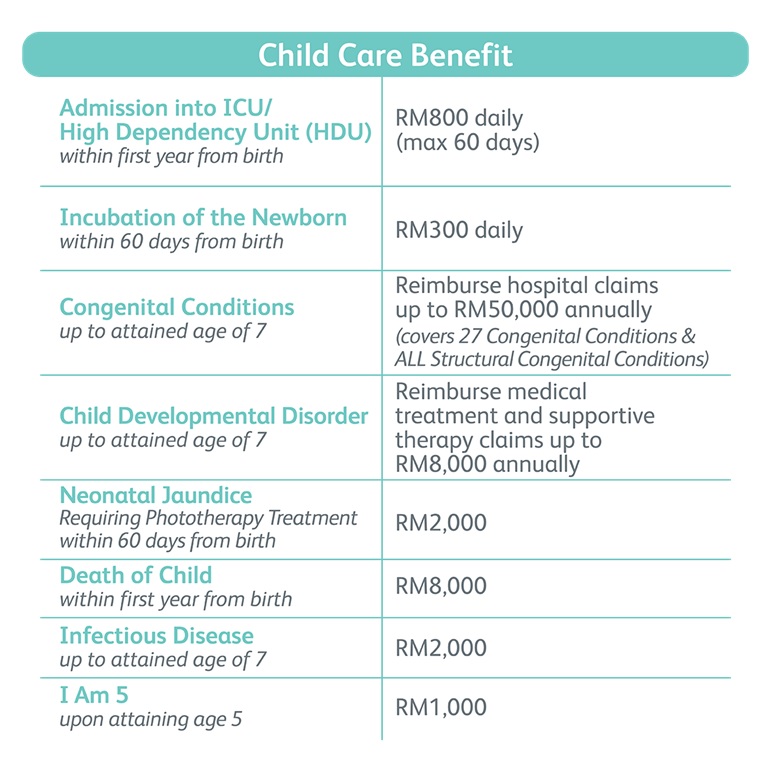

For the child, Prudential’s pregnancy insurance offers the following:

-

Admission into ICU/HDU

-

Incubation of the newborn

-

Congenital conditions

-

Child development disorder

-

Neonatal jaundice

-

Death of child

-

Infectious disease

Can I apply for maternity insurance if I am already pregnant?

Yes, it is possible to apply for maternity insurance with Prudential even if you are already pregnant.

Is it worth it to get maternity insurance?

Yes, maternity insurance is worth it because of the comprehensive protection if provides for pregnant mothers and their babies. For instance, Prudential’s PRUMy Child Plus offers benefits from 13 weeks of pregnancy and continues to cover the child until the age of 100. It helps alleviate the financial burden of pregnancy-related expenses, such as prenatal care, delivery and post-natal care, and also includes coverage for the child in the event of accidental death or disablement.

Can I change insurance if I am pregnant?

Yes, you can. However, there may be certain limitations on when and how you can make the change, depending on the specific insurance plan you currently have. The best way to go about this is to check with your Wealth Planner for more information.

How much does maternity insurance cost?

The cost of maternity insurance varies, depending on factors such as the insurance plan, one’s age and the coverage you want.

Who can buy maternity insurance?

All mothers who are expecting or are already expecting can purchase maternity insurance.

Why consider life insurance for your child?

Life insurance for your child is important because:

-

Financial security: If the parent were to pass away, the life insurance policy would provide financial support for the child.

-

Future expenses: Life insurance policies for children can accumulate cash value over time, which can be used to help pay for future expenses such as education or a down payment on a house.

-

Potential savings: Life insurance policies for children tend to be less expensive than policies for adults, so they can be a cost-effective way to provide financial protection for your child in the future.

-

Early coverage: Starting coverage at a young age may guarantee coverage at a lower cost due to the child's health, and also would give them time to accumulate cash value.

How much life insurance coverage should I consider for my child?

There is no ‘right’ amount to purchase. However, a general rule of thumb with life insurance policies is that they can provide enough money to cover your child’s future expenses. This would include the cost of education, living expenses, and housing until they are financially independent.

More Pregnancy Articles

Extra riders that can be attached to PRUMy Child Plus

You can also add extra plans to strengthen your coverage. Choose from plans that provide:

Child and Mother Protection |

|

Medical Protection |

|

Critical Illness Protection |

|

Accidental Protection |

|

Payor Benefit Protection |

|

Savings For Education Fund |

*The rider can only be attached when PRUSaver or PRUSaver Kid and the respective payor basic is attached.