Your journey, your strength. Resilience with Prudential.

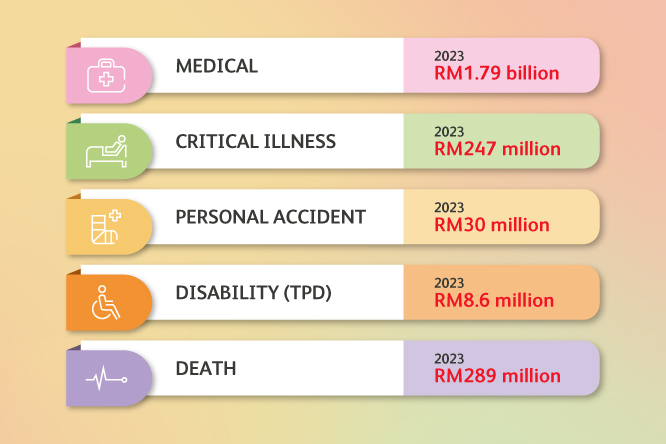

At Prudential, we deliver on our promise to provide our customers with financial freedom and peace of mind. In 2023, we paid RM2.37 billion in claims in medical, critical illness, personal accident, death and total permanent disability claims, marking a 16% increase from the previous year, along with 23% increase in total claim cases compared to 2022.

Our mission, to be your trusted partner and protector drives us to help you achieve life’s potential while attaining the financial security you deserve.

Amount Paid by Claim Type

Medical Claims Payout

Overview:

- Medical claims have increased by 23% due to higher utilisation and medical inflation.

- Breast Cancer is the top claimed medical condition, with a 17% increase from 2022.

- Cataract cases are rising among the 21-40 age group, with claim cases increased by 27% from 2022.

- Top 5 diagnosis included Breast Cancer, Cataract, Ischemic Heart Disease, Gastritis and Acute Gastroenteritis.

Critical Illness

Claims Payout

Overview:

- Cancer Disease is the highest claimed condition, with a 23% increase from 2022.

- 28% increase in claims amongst 21-40 years old compared to 2022.

- 67% increase in stroke claim cases amongst 21-50 years old compared to 2022.

- Top 5 diagnosis included Cancer Disease, Heart Disease, Stroke, Kidney Disease, Brain Disease/Injury.

Death Claims Payout

Overview:

- Heart disease overtook cancer-related conditions as the top claimed case under death claims category in 2023.

- 12% increase in heart disease death claims amongst 31-50 years old compared to 2022.

- Top 5 diagnosis includes Heart Disease, Cancer Disease, Infectious Disease, Accident, and Pneumonia.

Understanding The Rise of Medical Claims Cost

What Causes the Increase in Medical Claims Cost

Increase in number of Policy Owners Claiming:

Due to the rise of choronic diseases and outbreaks of viral infections, which are expensive to treat and the general increase in the utilisation of healthcare service.

Increase in Average Hospital Bills:

The rise in hospital tariffs, coupled with a shortage of medical staff and currency depreciation contributes to hospital bills.

Click here to find out more.