Stay Worry-Free With Our Medical Plans Today

Medical insurance is essential to protect you and your loved ones from high medical costs.

We understand the importance of protecting your health, which often comes with a significant price tag. From consultations to treatments and other related expenses, the costs can quickly accumulate and potentially to rise due to medical inflation.

That's why we provide a wide range of comprehensive with flexible options medical insurance plans for you to choose to meet your need.

These plans are also carefully tailored to ensure affordability while shielding you from the financial impact of medical inflation and the extended recovery periods associated with serious conditions.

Rest assured, with our medical plans, you can have peace of mind knowing that you are covered and well-protected.

Benefits for you

Plan that suits your needs

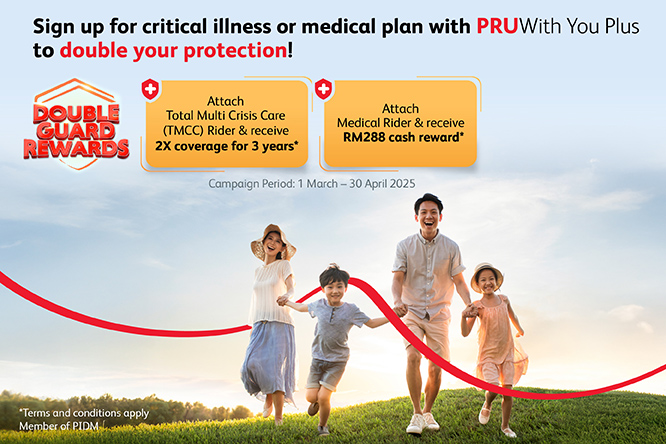

Double Up Your Protection and Earn Cash Reward!

Sign up for PRUWith You Plus with a medical rider attached and enjoy RM288 cash reward.

Terms and conditions apply.

Frequently Asked Questions

What is health insurance?

Health insurance covers medical expenses that may arise due to an illness. These could include hospitalisation costs, medicine costs, and doctor consultation fees.

Additionally, some health insurance plans can also offer coverage for critical illnesses to cover certain life-threatening diseases.

Health insurance policies are usually of the following types:

-

Individual health insurance

-

Critical illness health insurance

-

Group health insurance

What is the difference between health insurance and medical insurance?

"Health insurance" usually covers a wide range of health-related expenses, including medical care, preventive services, and sometimes additional services like dental and vision care. It provides financial protection against healthcare costs, with coverage for hospitalization, doctor visits, surgeries, prescription drugs, and more.

"Medical insurance" refers more narrowly to coverage specifically for medical treatments and procedures.

Both terms are used interchangeably in many contexts, but health insurance often encompasses a broader spectrum of healthcare services beyond just medical treatments.

Why is health insurance important?

Health insurance benefits are unmeasurable.

This is because falling sick or getting hurt is never planned. A serious disease or accident can strike at any time. However, one may not always be financially prepared or have enough savings to be able to pay the costs for treatment. A health insurance policy helps to protect individuals and their families in such circumstances.

Another important point to note is that the cost of medical treatment is rising continuously. Additionally, health insurance may require high premiums (or even be denied) as one gets older. It is, therefore, recommended to buy a health insurance policy as early as possible.

What is a health insurance premium?

This is the amount to be paid by the policyholder for their health coverage. It is billed each month and should be paid by the policyholders regardless of whether they need any healthcare facilities.

How are health insurance premiums calculated?

A health insurance premium is an amount to be paid by the policyholder in return of the coverage. It is calculated depending on your age, insurance sum assured, medical history, type of plan selected, etc.

What happens if I miss a health insurance premium payment?

Missing a premium payment may result in the lapse of your medical insurance coverage. Do contact our customer service as quickly as possible to discuss options and reinstate your policy if you have missed payments.

What is the best health insurance available in Malaysia?

There are a few types of health insurance available in Malaysia: surgical or hospitalization, critical illness insurance and long-term care. The right plan for you depends upon your age, family history and affordability.

How do I pick a health insurance plan?

It depends on your healthcare needs which in turn, depends on your age and pre-existing conditions. You can go with a basic plan if you are healthy or choose a more comprehensive coverage to get maximum benefit and protection when needed. Speak to a Prudential Wealth Planner to help you determine what is best for you.

How do I choose an individual health insurance plan?

To have the best health insurance plan for individuals, you can choose a plan for yourself by assessing your financial and health condition. Compare different plans available depending on the premium rates and the coverage provided. Choose a plan that fits your budget and health needs in the longer run.

How much does health insurance cost in Malaysia?

On average, health insurance can cost up to RM 2500 per year. It can increase or decrease depending on the coverage required and differs between insurance providers.

What are the benefits of health and life insurance?

Health insurance can cover the expenses of your medical costs and disease treatments, if you are at risk of getting any. Whereas, life insurance pays out a death benefit to your beneficiaries in case of premature death to cover future income loss and other obligations outstanding such as funeral cost, hospital expenses and outstanding debts.

What happens if I exceed the annual limit for medical expenses?

If you exceed the annual limit for medical expenses, you will have to pay for the additional costs out of your pocket. However, some plans may offer other benefits or top-up options to cover the excess.

Is there a waiting period before my medical insurance coverage begins?

Yes, there may be a waiting period of 30 days for hospitalisation and surgery. However, wait times for some conditions depend on the plan and the type of treatment required.

Do Prudential medical insurance plans cover pre-existing conditions?

This depends. You may have to undergo a medical examination and submit a doctor's report so that we can review your condition.

Can I choose my preferred hospital or healthcare provider with my medical insurance?

Yes, you can choose your preferred hospital for treatment, provided it is within the network of hospitals and clinics covered by your medical plan. Prudential has a vast network of healthcare providers to ensure you access quality healthcare services.

What happens if I need medical treatment when I am overseas?

Medical insurance plans may offer limited coverage for medical emergencies when you’re abroad. If you travel frequently, it is best to check the details of your plan for international coverage. Consider a supplemental travel coverage, or a medical insurance plan that is designed to cover you when you’re overseas.

Can I cancel my medical insurance plan anytime?

Yes, you can cancel your medical plan anytime. However, you may be subject to cancellation fees or penalties depending on the terms and conditions of your policy.