US Market Outperforms in October as Global Markets Consolidate

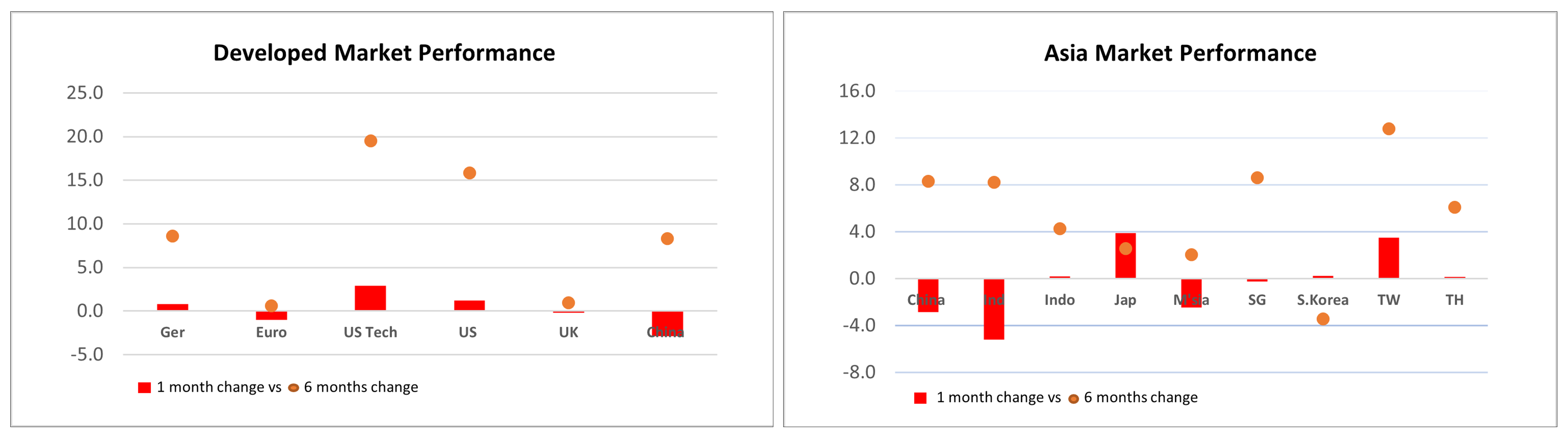

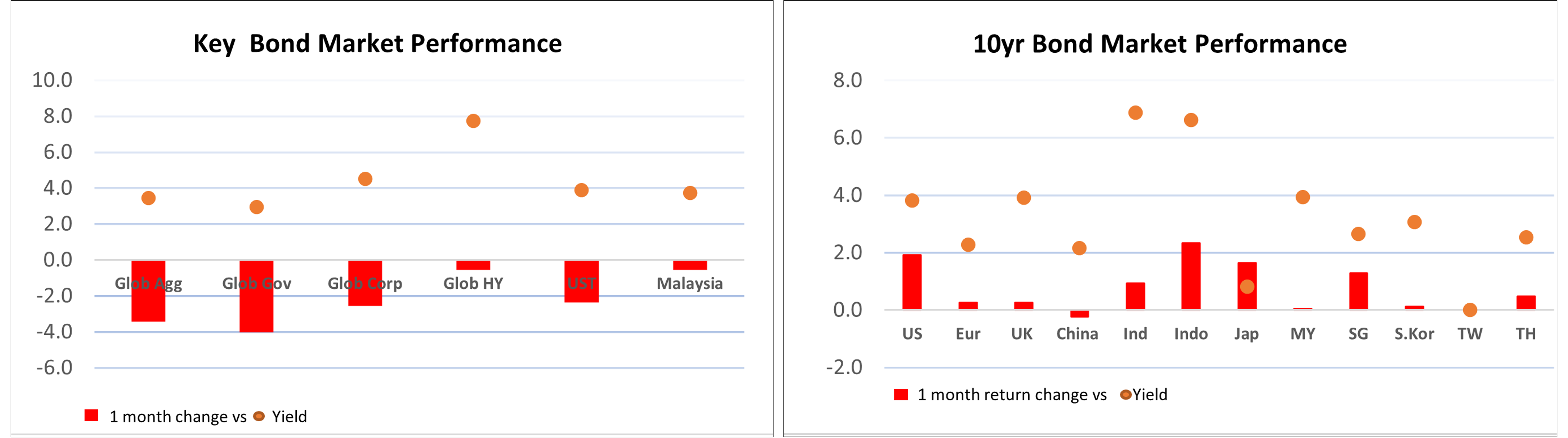

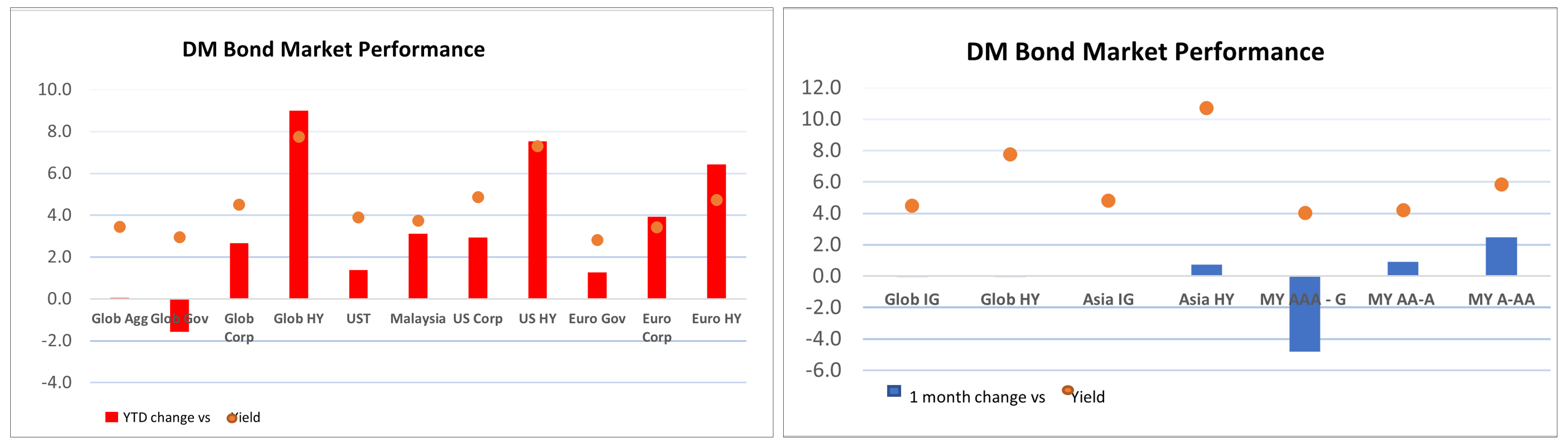

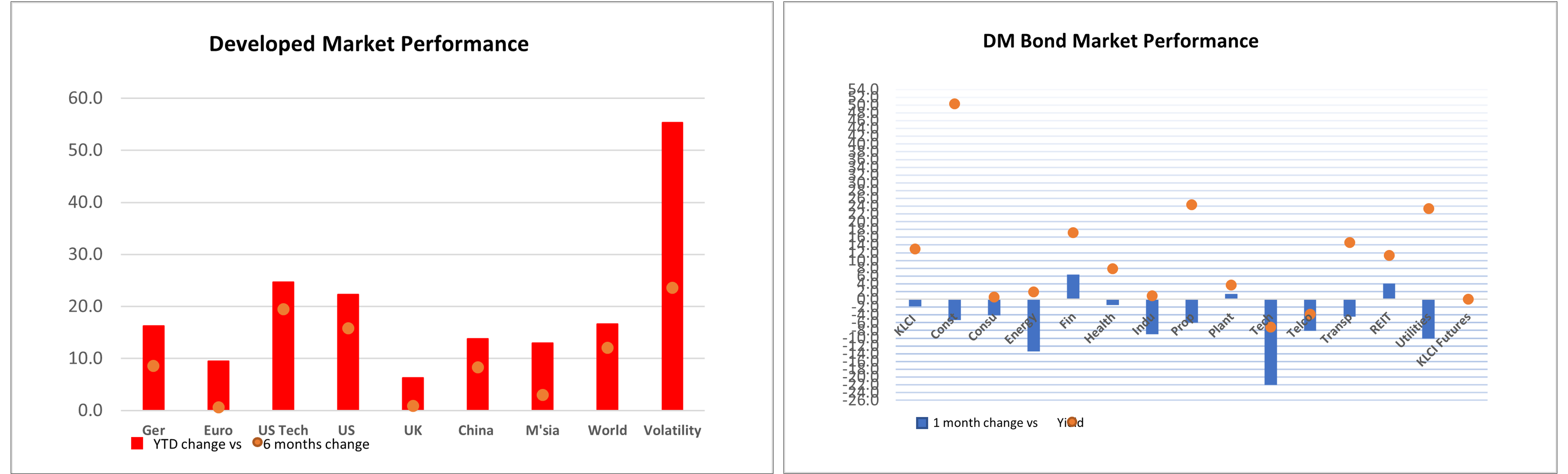

Except for the US market showing positive performance, the market broadly consolidated in October. The global equity market was down -0.43% month-on-month (“MoM”) and the bond market was down -3.42% MoM. Similarly, Malaysia equity market was down -1.46% MoM and the bond market was down -0.54% MoM. Despite recent market consolidation, global markets continued to deliver positively year-to-date (“YTD”) returns (global equity +16.65% YTD, local equity +12.98%, global bond +0.06% and local bond +3.12%), as backed by resilient global economic fundamentals though weaker economic momentum.

The US’s positive equity market performance, up +1.22% MoM, came in tandem with the stronger USD, up +3.23% MoM. The positive drivers were the surprisingly strong September nonfarm payrolls, up 254k, unemployment rate decline to 4.1%, improving consumer sentiment and expectations, and still rather expansionary economic activity driven by robust services growth. However, such resilient economic backdrop coupled with inflation declining at a slower pace, with September CPI at 2.4%, still above the 2% Fed target and consumer 1-year inflation expectations up to 2.9%, led to lower rate cut expectations of another 50bps by the end of 2024 and about 1% in 2025. Overall, the US economic soft-landing narrative remains, with recession risk not imminent.

However, this month, the China equity market consolidated, down -2.85% MoM from its aggressive run by +40% in late September till early October. But the China equity market remained positive +13.76% YTD as overall the China macro fundamentals seem to stabilise and chug along positively.

China’s 3Q GDP recorded moderately better than expected at 4.6% YoY, with notable upside growth in industrial production (5.4%), retail sales (3.2%) and 3.4% fixed investment (5.4%). Although loan growth and housing activity remained weak, export activity moderated, and deflationary pressures continued to linger, these soft data points seem to be bottoming out. Also, Chinese banks lowered the loan prime rates by a larger-than-expected 25bps in October.

Thus, coupled with the bazooka of policy measures announced recently, such bottoming domestic activity and policy tailwinds potentially provide a backstop to further equity market decline. However, the anticipated details on the fiscal budget deficit, which could increase to 3.5% GDP, would be the key tailwind for the continuation of equity market recovery, given the stability of domestic confidence and the housing market are essential with rising concerns of slowing external demand and easing global manufacturing sector activity.

On the local front, economic data recently released has been soft. August loan growth and industrial production growth moderated to 6% and 4.1% respectively, and September trade data also weaker than expected. But the 3Q GDP was stronger than expected, likely 5.3%. Budget 2025, tabled on 18th Oct, is prudent, continuing its fiscal consolidation journey while remaining expansionary by maintaining development spending of RM86bn to achieve 4.5% - 5.5% economic growth in 2025 (4.8 - 5.3% in 2024). The fiscal deficit is on track to meet the 3% target, as projected to fall to 3.8% in 2025, aided by a broader tax base and some subsidy rationalisation removal for foreigners and T15 consumers. Nevertheless, while Budget 2025 is sensible, the lack of mega projects, a broader service tax base, higher minimum wage, and the multi-levy mechanism to reduce the reliance on foreign workers led to lackluster local equity market sentiment. Meanwhile, BNM is likely to keep rates unchanged in the near term, given the wider range of headline inflation forecast of 2.0-3.5% for 2025 (2024: 1.5-2.5%), which likely accounts for potential cost-push and demand-pull inflationary risks.

Therefore, given Malaysia’s economic growth prospects remain intact with likely potential upside, overall, we continue to advocate our positive view on the Malaysian equity and bond market. The undemanding equity market valuation, stronger MYR prospect amid low foreign shareholding, and China recovery prospect should drive the Malaysian equity market higher. The bond market, capped by stable policy rate, will remain a good asset diversifier from risky assets while yielding stable returns. Meanwhile, we continue to accumulate global equity market on weakness. While risky assets remain supported by global central banks’ rate cut direction, the equity market will remain volatile due to diverging and uneven global economic paths. There are market opportunities as market performers have yet to broaden out from the high concentrated performers related to the technology-related sectors to the broader economy.

Given our more positive outlook on the local equity market, including Asia and the bond market, we prefer the PRULink Managed 2 Fund and PRULink Managed Plus Fund for investment diversification; the PRULink Equity Plus and PRULink Equity income for Malaysia exposure; and PRULink Asia Great Fund, PRULink Asia Equity Fund and PRULink Asia Managed Fund for Asia exposure.

Written by Esther Ong

Esther Ong is the Investment Market Strategist of Prudential Assurance Malaysia Berhad (PAMB).Esther is a qualified Chartered Financial Analyst as well as having obtained MSc Investment Management and BSc Insurance & Investment with a Financial Markets Association of Malaysia (Persatuan Pasaran Kewangan Malaysia or PPKM) license.

This feature is to provide general information on the current situation of the economy with the information available at the given time. This feature does not constitute investment advice and cannot be used or substituted as such. The opinions of the author may not necessarily reflect the views of Prudential Assurance Malaysia Berhad.