US Market Leads November Gains Amid Global Volatility

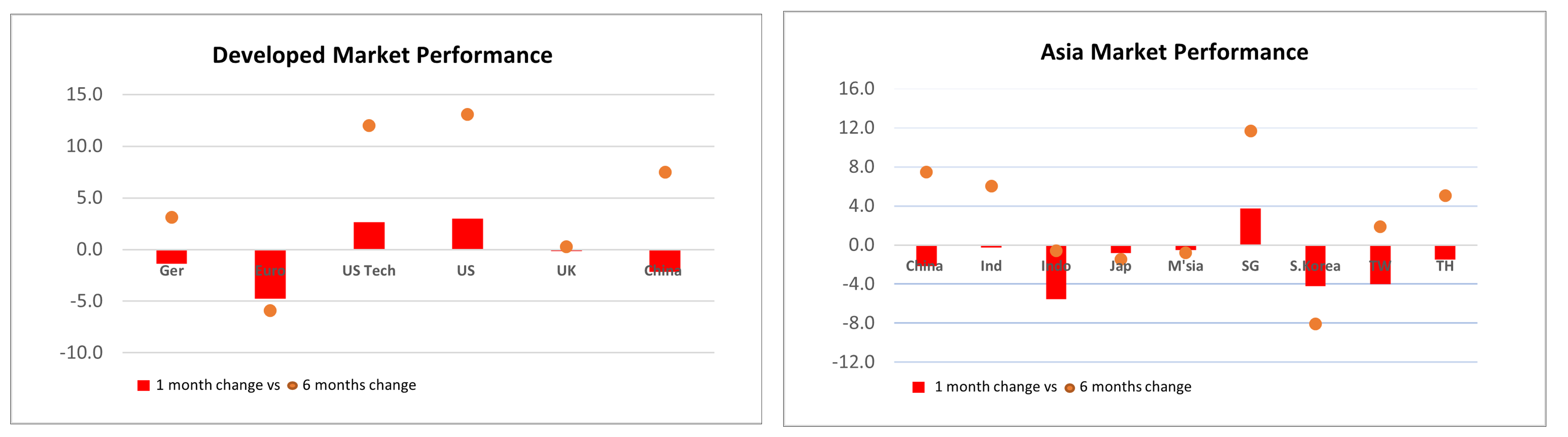

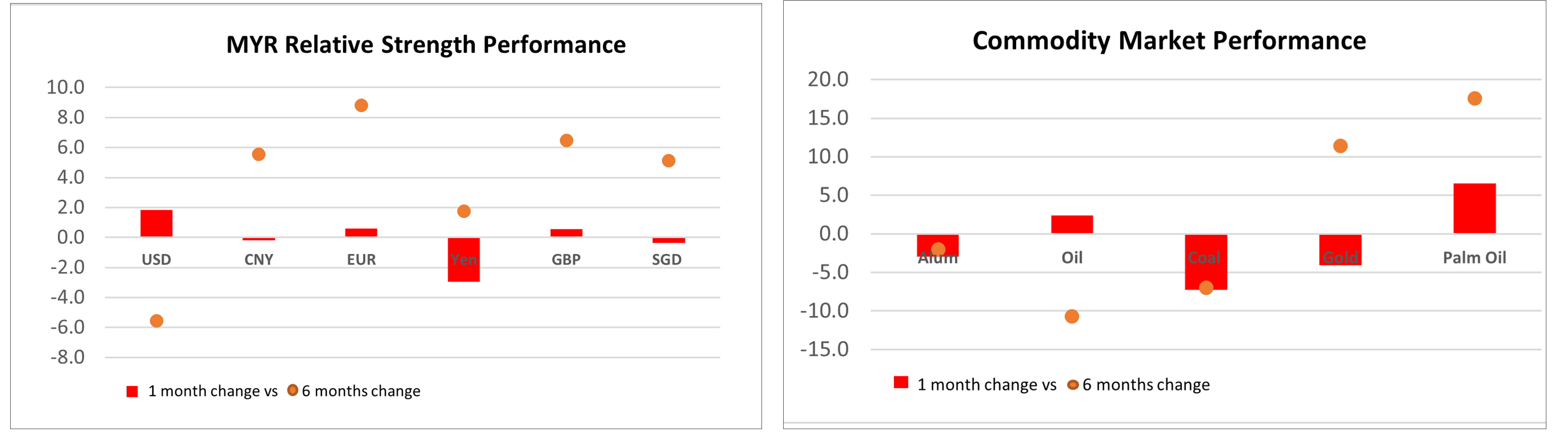

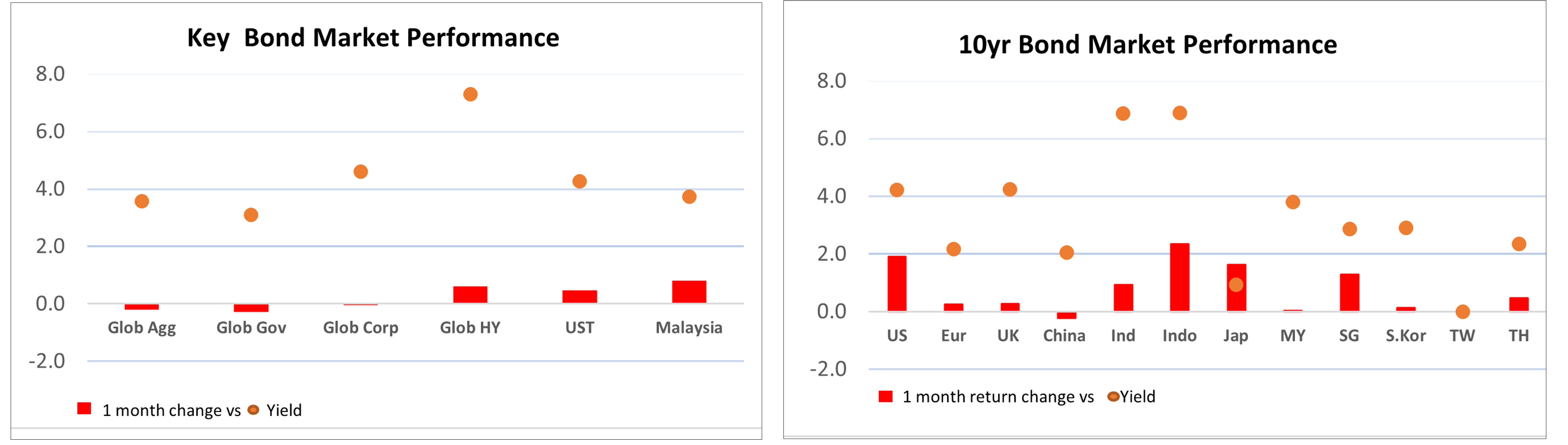

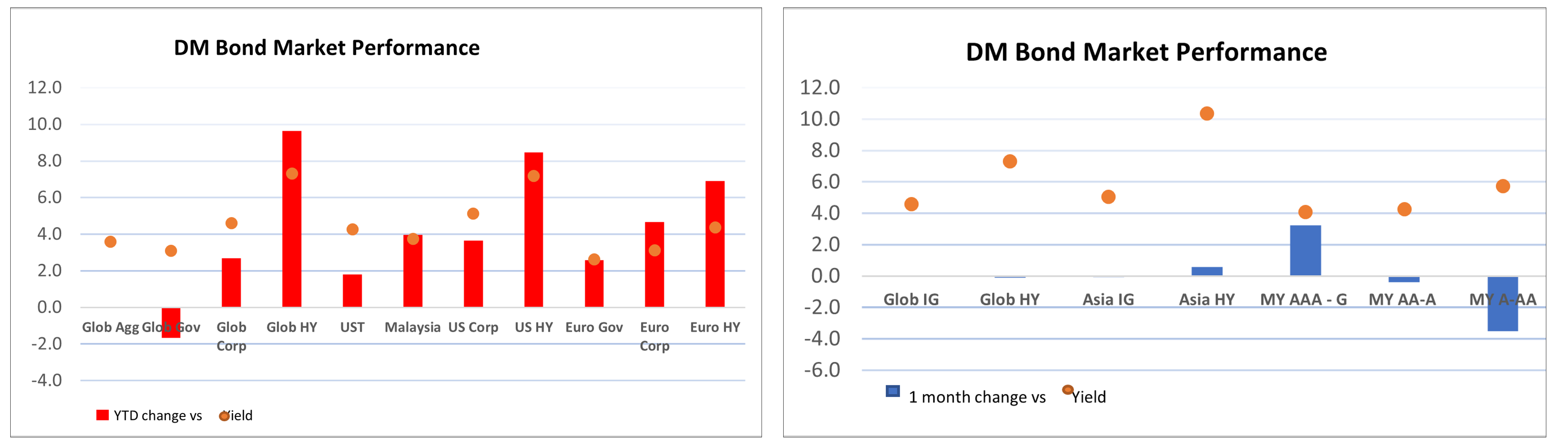

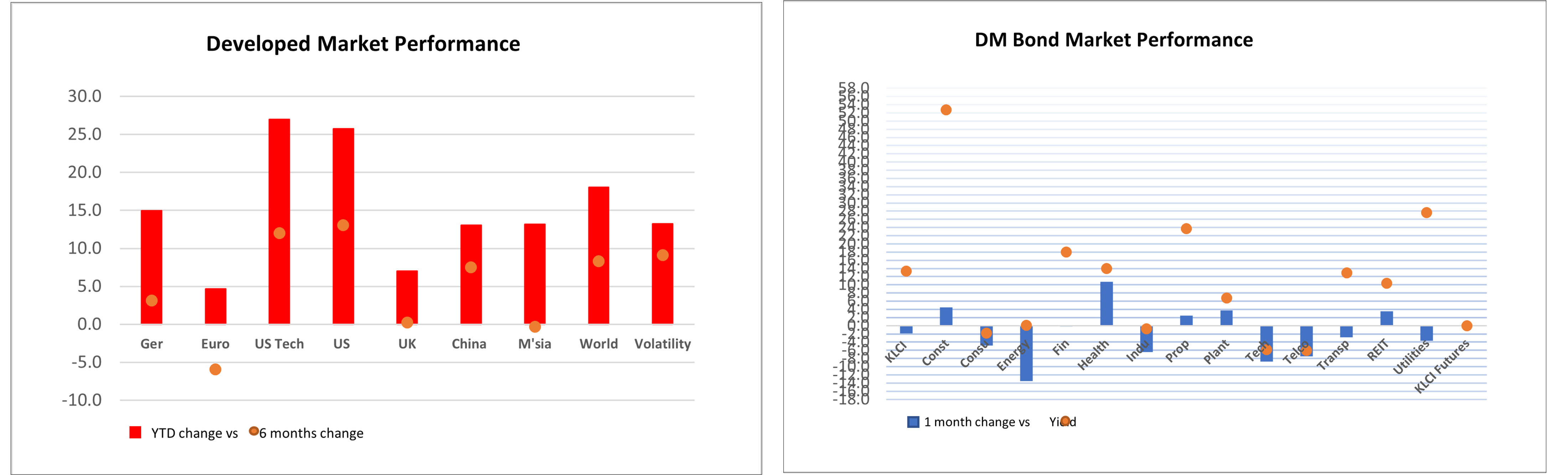

The US market continued to show outperformance in November, up +3.68% month-on-month (“MoM”), charting new highs against other markets. This led to global equities posting a decent positive return of +1.6% MoM. On the contrary, other regional equity markets, including Malaysia, fell (local equity down -0.66% MoM, China down -1.25% MoM, Eurozone down -4.46% MoM). Nevertheless, local bonds upheld their role as an asset diversifier, up +0.73% MoM, unlike the global bond market, which was down -1.02% MoM led by higher US Treasury yields.

Such market volatility and divergence in performance were very much anticipated given the key market event risk – the US Presidential election in November. Overall, the equity market still delivered a strong positive return year-to-date (“YTD”), with global equities up +18.17% YTD and local equity +13.57% YTD. Local bonds also posted gain +3.98% YTD, better return than fixed deposits.

With the Trump 2.0 win, the ensuing implementation of the Trump 2.0 election campaign policy agenda (mainly corporate tax cuts, higher import tariffs, immigration policies, deregulations) has raised market concerns, although the timing and extent are uncertain. Two main market risks are higher inflationary risk due to potential higher deficits and wages; and global growth (ex US) risk due to potential trade retaliatory responses. Together with the recent US inflation reported picking up MoM due to sticky shelter and services inflation, US interest rate cut expectations from now till the end of 2025 further dropped by 0.25% to 1% (3.75% - 4%), a far lesser rate cut than the 2% expected in September. As a result, unlike the US equity market filled with US growth optimism, the US bond market was volatile, with the 10-year US Treasury climbing further by +13bps to 4.41% (10yr US Treasury was at 3.78% at the end of Sept) before ending up +3bps to 4.26% when Scott Bessent, who is believed could balance the Trump 2.0 conflicting policy agenda, was nominated to be the next Treasury Secretary.

On the economic fundamental front, global economic activity in October accelerated. While led by services activity, manufacturing breadth also picked up, supporting market optimism that global growth remains resilient despite on a moderating path. While Eurozone growth was lackluster, China growth saw positive momentum following its recently announced stimulus measures, which are mainly to ease debt burden, improve liquidity and stabilise the property market. Nevertheless, despite China’s rebound in retail sales and drop in the unemployment rate in October and somewhat improving property sales in November, the market remained unexcited as the stimulus measures have yet to be impactful enough to elevate consumer spending doldrums and mitigate the supply-demand imbalances as well as the potential negative impact of higher US tariffs. Having said that, China market still recovered to +14.35% YTD.

Locally, Malaysia’s economic fundamentals remain positive. 3Q2024 GDP rose +5.3% YoY, driven largely by 7% higher domestic demand growth, largely lifted by stronger private and public investment growth of 15.5% and 14.4% respectively. With the growth path remaining steady, the full-year 2024 economic growth is likely to fall within the MOF’s projection of 4.8% - 5.3%. Meanwhile, domestic inflation remained stable at 1.8% YoY in October, supporting BNM in keeping the policy rate unchanged at 3% in November. Overall, we continue to advocate positive view on the Malaysian equity and bond market given the domestic catalysts such as expansionary fiscal policy, favourable labour markets, implementation of national masterplans and high-impact projects, as well as stable interest rates. The higher US import tariff risk is likely to have lesser impact on Malaysia in anticipation of trade diversion from China to China Plus One countries like Malaysia. Besides, China’s recovery prospects should drive the Malaysian equity market higher.

Meanwhile, the global equity market, while positive in the near term, is likely to be volatile given uncertainty over the implementation of the Trump 2.0 economic policy agenda and the resulting risk of US interest rates staying high longer. As such, while risky assets remain supported by global central banks’ rate cut direction, the equity market will remain volatile due to diverging and uneven global economic paths. As such, investment diversification is important to counter market volatility.

Given our more positive outlook on the local equity market, including Asia and the bond market, we prefer the PRULink Managed 2 Fund and PRULink Managed Plus Fund for investment diversification; the PRULink Equity Plus and PRULink Equity Income for Malaysia exposure; and the PRULink Asia Great Fund, PRULink Asia Equity Fund and PRULink Asia Managed Fund for Asia exposure.

Note: 26th Nov 2024

Written by Esther Ong

Esther Ong is the Investment Market Strategist of Prudential Assurance Malaysia Berhad (PAMB).Esther is a qualified Chartered Financial Analyst as well as having obtained MSc Investment Management and BSc Insurance & Investment with a Financial Markets Association of Malaysia (Persatuan Pasaran Kewangan Malaysia or PPKM) license.

This feature is to provide general information on the current situation of the economy with the information available at the given time. This feature does not constitute investment advice and cannot be used or substituted as such. The opinions of the author may not necessarily reflect the views of Prudential Assurance Malaysia Berhad.