Strong Fundamentals Drive Local Equity Market’s Outperformance

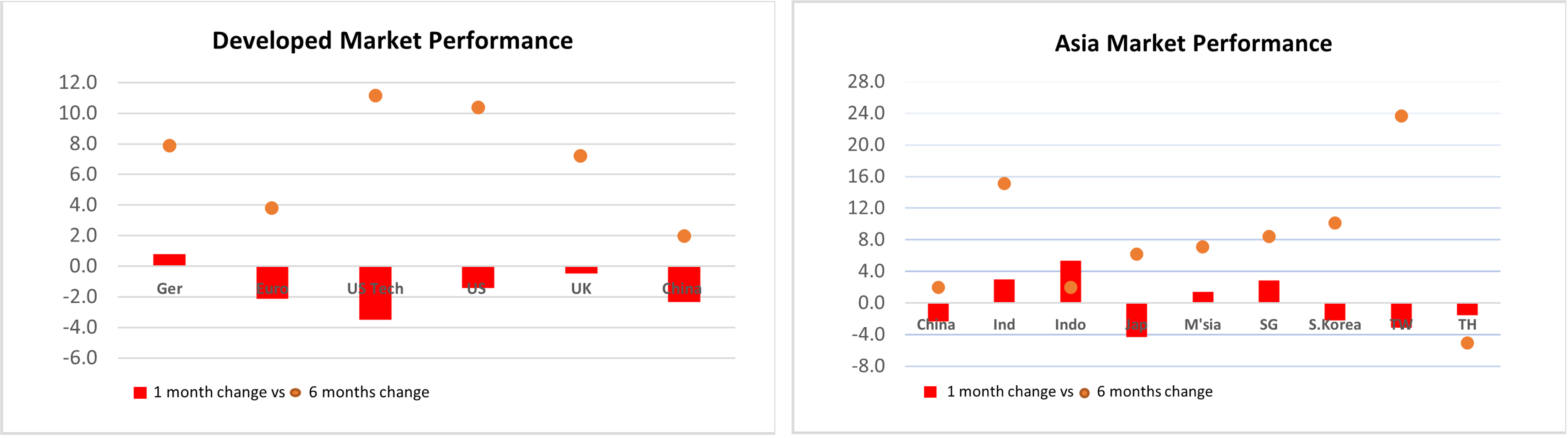

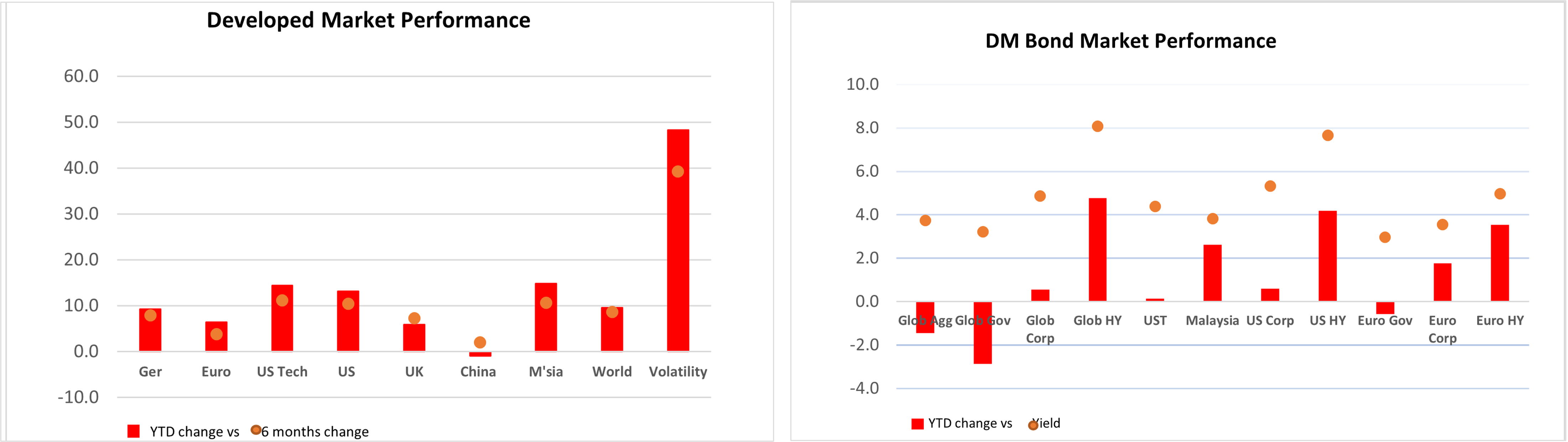

In July, equity markets globally behaved in divergence. Contrary to June, the global equity market eased with a -0.07% Month-on-Month (MoM) decline, while the local equity market rebounded 2.25% MoM. In tandem with our favorable outlook on the local equity market, the local equity market garnered +15.04% Year-to-Date (YTD), outperforming the global equity market (YTD 10.24%) by 4.80%. The key market movements were the recovery of the broader market on lower rates expectations and the decline in technology-related shares on concerns of overhyped AI earnings potential and its extreme valuations. The US technology index was down -3.3% MoM, Taiwan down -4.2%, and Korea down -1.8%.

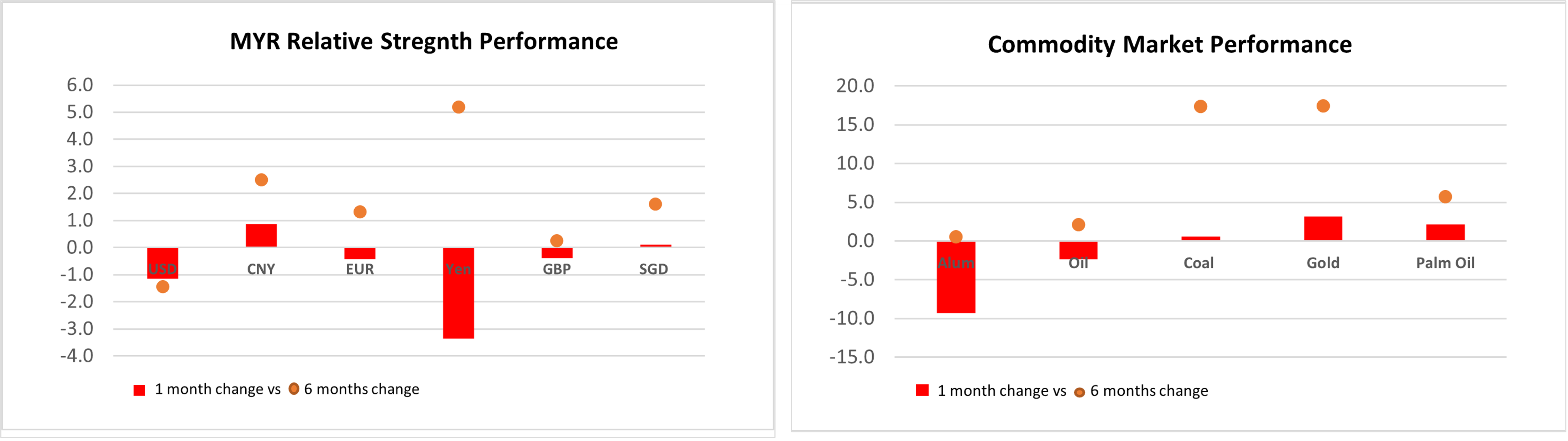

The local equity market performance was robust, supported by strong fundamentals, still undemanding valuations, and an increase in US rate cut expectations. Malaysia’s 2Q24 GDP is estimated to surpass expectations with a sharp spike to 5.8% Year-on-Year (YoY) (vs +4.2% in 1Q24), bringing 1H GDP to 5%, within the BNM estimate of 4% - 5%. The growth drivers are expected to continue to stem from resilient corporate earnings and household spending growth, ongoing multi-year investments, and higher FDI (1Q24 Malaysia committed investments up 13% YoY) surrounding energy transition and regional infrastructure developments, the ongoing global tech upcycle, and improving tourism. This was despite some pullbacks seen recently in industrial production, export and import growth. Meanwhile, Malaysia’s monetary policy rate is also expected to remain growth supportive at 3% as BNM strikes a balance with inflation risk, which has remained manageable thus far at 2% in June despite the growth momentum, services tax adjustment, and the ongoing subsidies reform in areas such as electricity, water, and diesel. The subsidy removal for RON95 fuel prices would likely be gradual and mitigated by policy measures such as targeted subsidies and civil service pay hike in Dec 2024.

Externally, US economic growth remained resilient, expanding more than expected with 2Q GDP reported at 2.8% (vs +1.4% in 1Q2024). However, economic momentum has slowed since 2H2023 and is expected to continue to ease in 2H2024 as consumer spending moderates amid slower payrolls growth and waning support from excess pandemic savings. Meanwhile, both the Euro and China macro pictures are less rosy as the economic momentum ebbs. Nevertheless, recovery remains intact for both as Euro growth will be supported by consumer spending amid disinflation and lower interest rates, while for China, growth is supported by ongoing various fiscal policy measures and spending execution, housing stabilising measures, steady export activity, and further rate cuts. On the latter, China recently surprised the market with lower financing rates in July given China’s 2Q GDP came in notably below expectations, growing 4.7% (vs 5.3% in 1Q2024) and US benign inflation readings improved the clarity of the Fed rate cut. The lower financing rates could help to arrest weak retail sales and housing sales, which have been an overhanging risk.

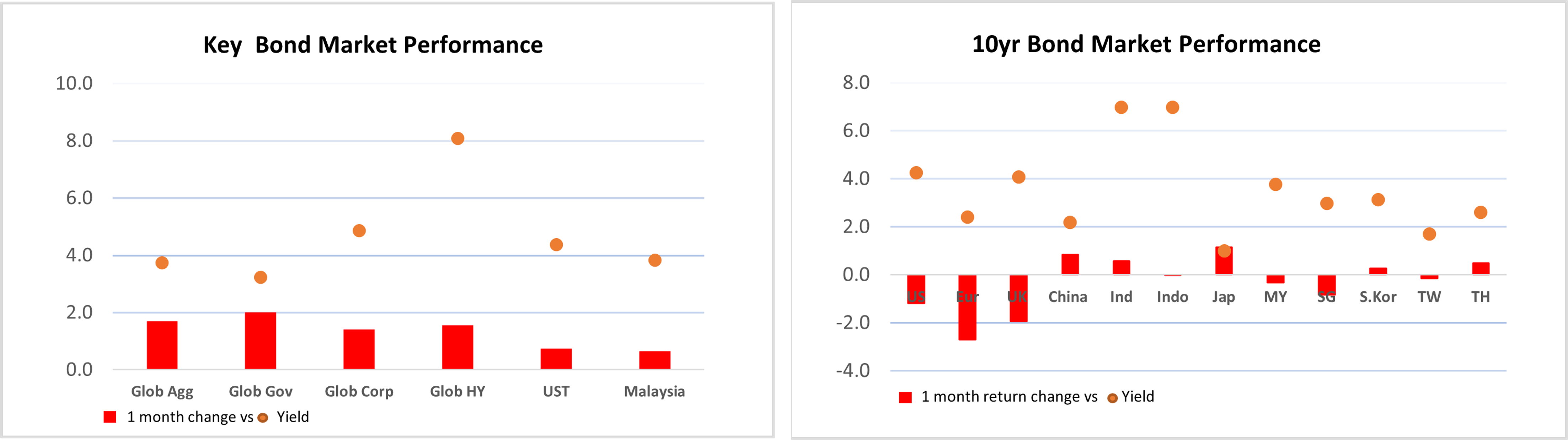

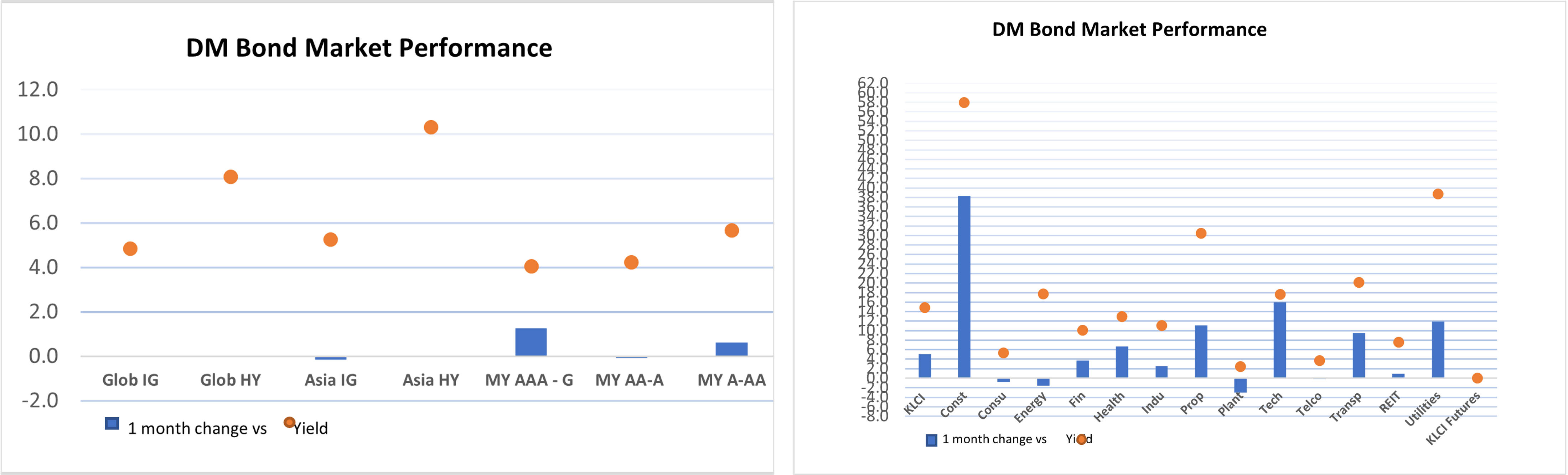

Therefore, amid slower global growth coupled with US disinflation remaining on track and the Fed’s dovish tilt statement, expectations of a US rate cut rose to 2-3x with the first cut starting in Sept 2024. This led to an overall positive bond market. The global bond market was up 2.08% MoM, narrowing YTD losses to -1.15% and, local bond market traded more positively, up +0.93% MoM, improving YTD gains to +2.9%. Nevertheless, market caution on rates staying higher for longer remains given both Fed and ECB policymakers are still data-dependent, ensuring that inflation is moving sustainably towards target.

Given the fundamental backdrop and possibility of a “higher for longer” rates landscape despite upcoming US rate cuts, we maintain our view that global equities, including Malaysia, are likely to continue to consolidate for a while. The market needs to watch if the positive economic data and disinflation trend remain on track, as well as if corporate earnings continue to deliver as expected or exceed expectations. The local market, having been swamped with a series of positive themes, would likely need continuous news flow, supportive Budget 2025 measures, and on-track earnings delivery progress for the next upward leg. Meanwhile, further upside could also stem from foreign capital inflows and any receding overhanging risk of China’s recovery pace, while downside risk could also stem from upcoming US election outcome. which could bring substantial changes to policies and regulation related to trade and fiscal spending.

Therefore, keeping our constructive preference for local equity market, including Asia, for better expected return relative to risk, we view any weakness in the current market consolidation as an investment opportunity to accumulate further. Meanwhile, investment positioning in the local bond market remains for risk diversification and expected stable return. Given our more positive outlook on the local equity market, including Asia and the bond market, we prefer the PRULink Managed 2 Fund and PRULink Managed Plus Fund for investment diversification; the PRULink Equity Plus and PRULink Equity income for Malaysia exposure; and the Asia Growth Fund, PRULink Asia Equity Fund and PRULink Asia Managed Fund for Asia exposure.

*Return is as of 30/7/2024

Written by Esther Ong

Esther Ong is the Investment Market Strategist of Prudential Assurance Malaysia Berhad (PAMB).Esther is a qualified Chartered Financial Analyst as well as having obtained MSc Investment Management and BSc Insurance & Investment with a Financial Markets Association of Malaysia (Persatuan Pasaran Kewangan Malaysia or PPKM) license.

This feature is to provide general information on the current situation of the economy with the information available at the given time. This feature does not constitute investment advice and cannot be used or substituted as such. The opinions of the author may not necessarily reflect the views of Prudential Assurance Malaysia Berhad.