Mixed Performance and Economic Insights in Global Markets

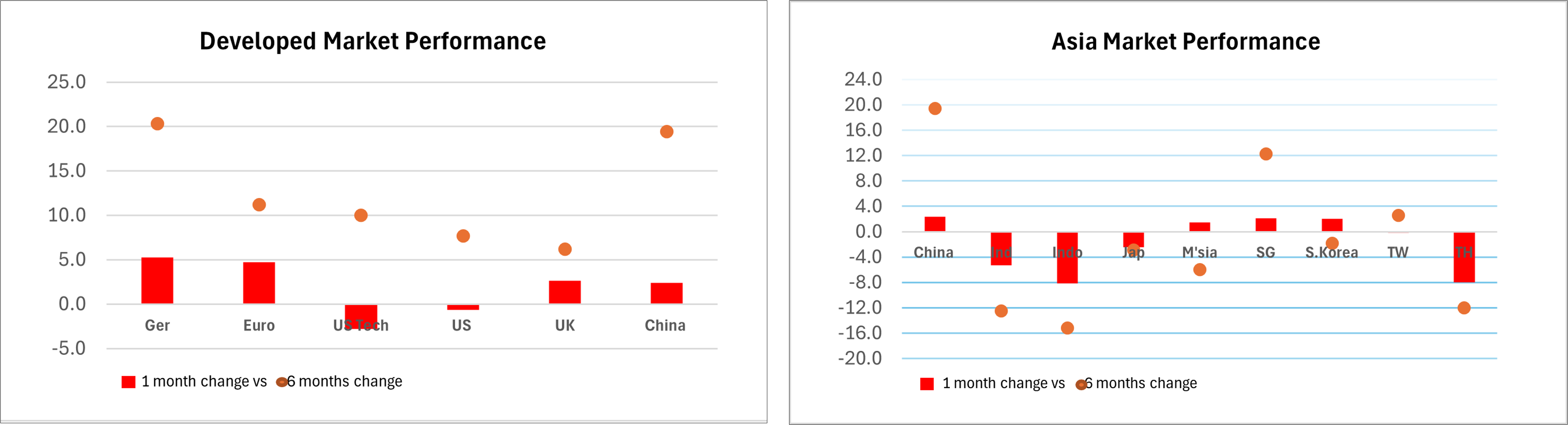

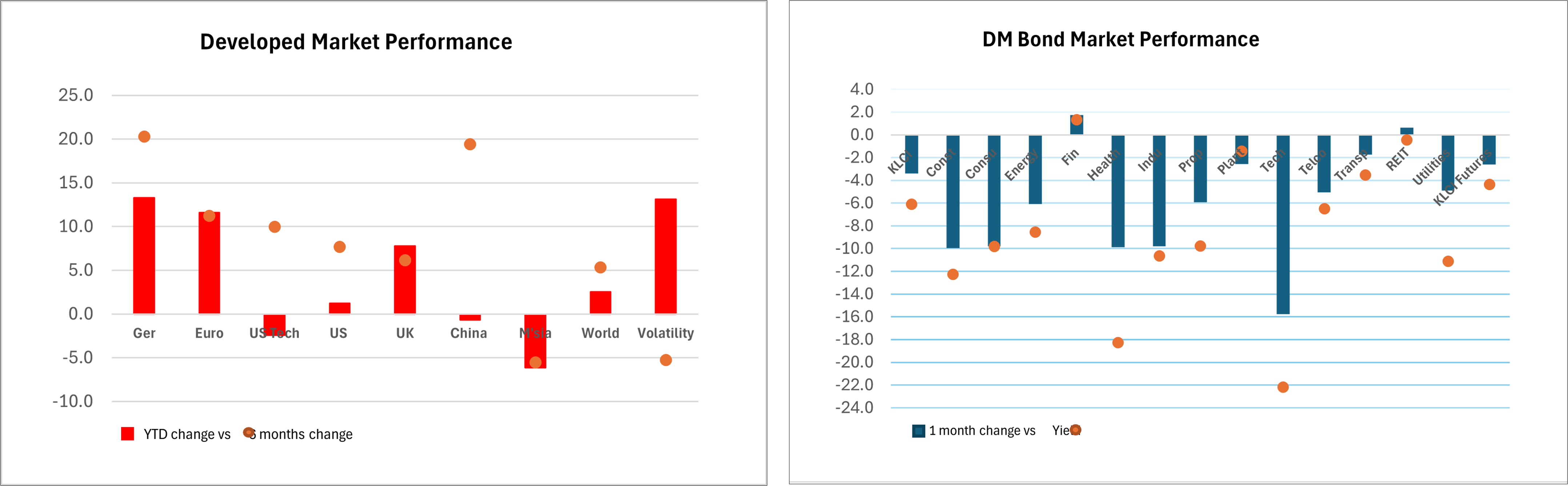

Equity market performance varied globally, as did the bond market. Global equity was flat 0.42% month-on-month (“MoM”), stemming from the outperforming markets like Europe (+4.7% MoM), the UK (+2.6%), and selective Asia (China +2.4% MoM, Singapore +2.1%), but weighed down by underperformers like the US (-0.67% MoM), US tech (-2.81% MoM), and selective Asia (Malaysia -0.4% MoM, Indonesia -8.1% MoM, Thailand -8% MoM). With the mixed bag of equity performance in Feb, overall equity market performance globally was also mixed cumulatively year-to-date (“YTD”), with global equities ending marginally positive +2.5% YTD. The outperforming markets remained Europe, which was up +11.6% YTD while the US was flat +1.2% YTD, weighed down by US technology sector (-2.4% YTD). Malaysia equity also performed poorly YTD at -6%.

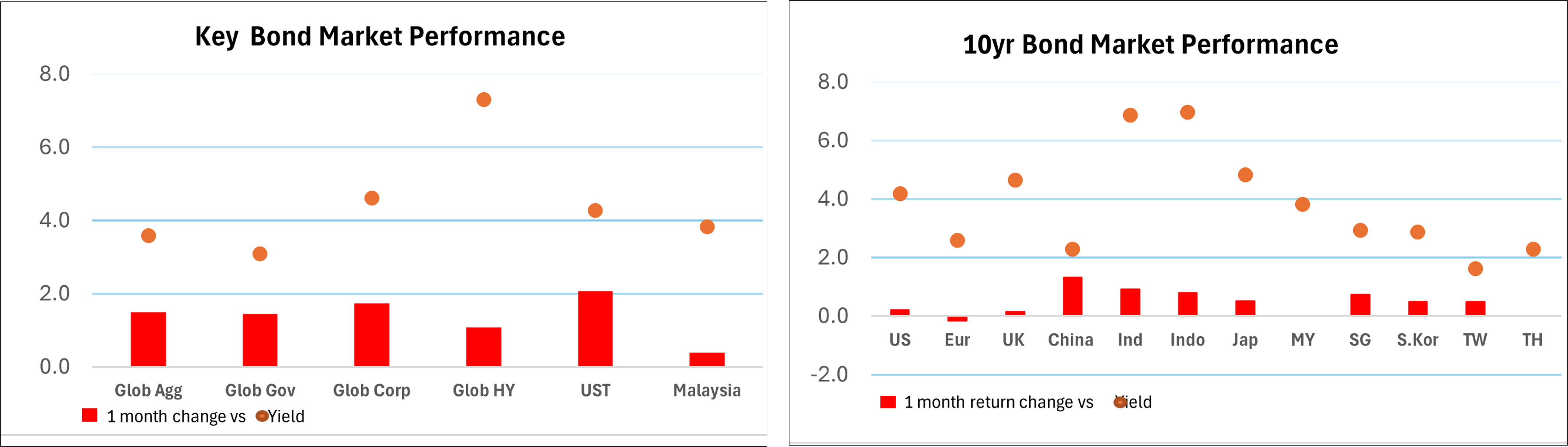

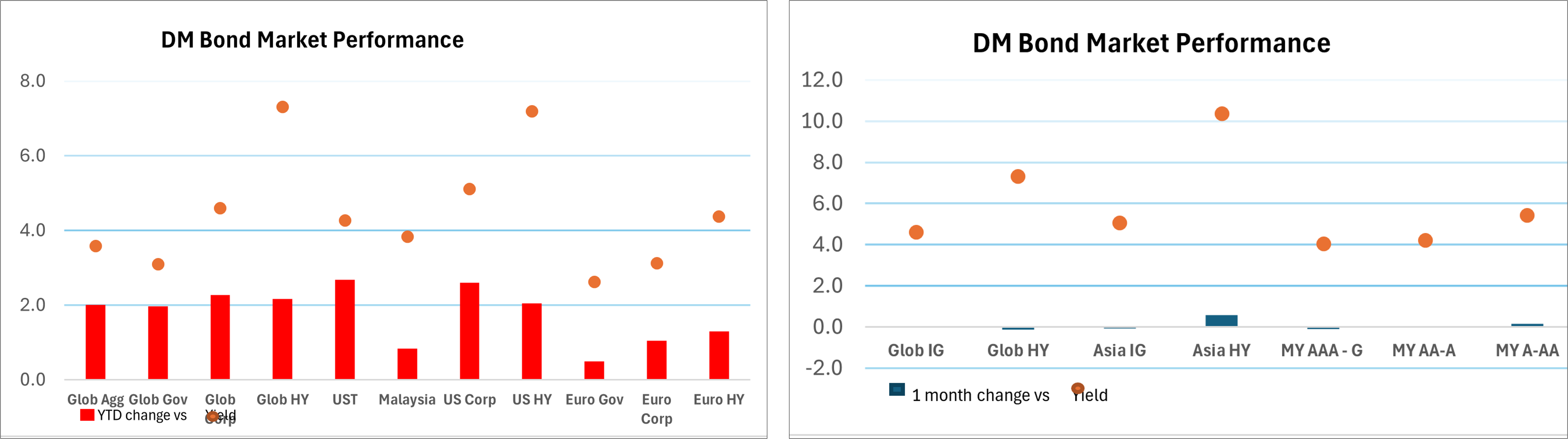

Meanwhile, the global bond market garnered a decent return of 1.5% MoM, as US government bond yields shifted lower, with the 10-year US Treasury down by about 23bps to 4.21%. In tandem with the US bull flattening yield curve shift, US Treasury yielded 2.07% MoM (2.68% YTD), and the Malaysian bond market also garnered positive return of +0.4% MoM (0.8% YTD).

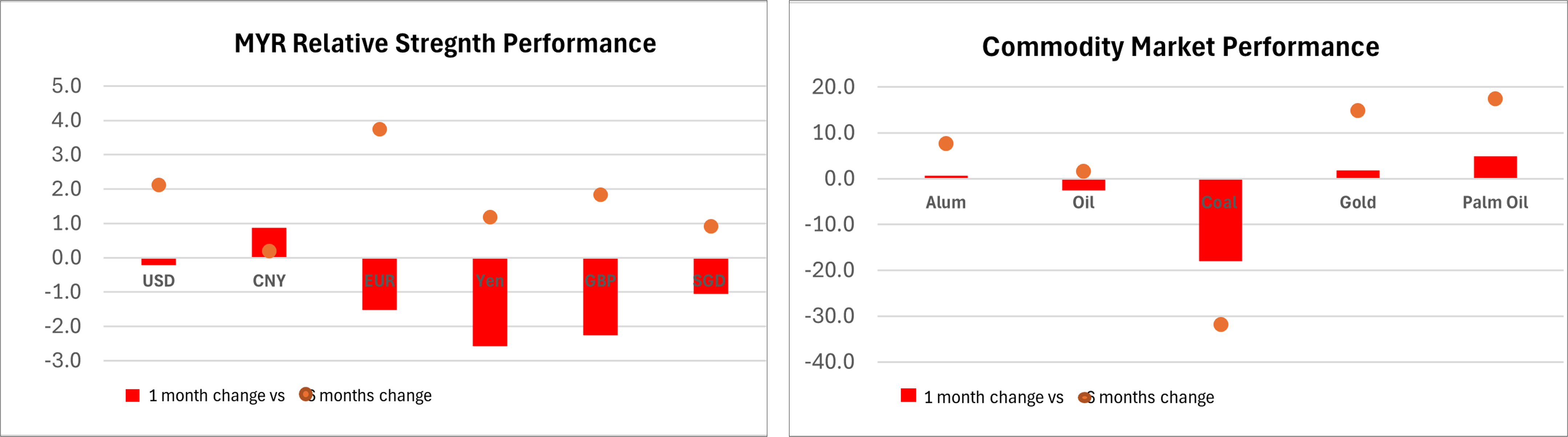

The diverging market performance globally is due to diverging monetary policy directions. The US Federal Reserve kept rates unchanged in Jan due to a sticky inflation rate and rising inflationary risk from US tariffs, while both labour demand and the growth rate remained resilient. However, the ECB cut rates twice in Jan – Feb period to 2.90%, and the UK cut rates once in Feb to 4.5% on weak growth, although inflation has yet to fall to target. However, the recent release of softer US labour market and inflation rate led to a downward shift in US rate cut expectations from 2 rate cuts to 3 rate cuts this year. The market’s more dovish expectations led to some price support for both equity and bond market momentum. Separately, US corporate results were largely positive, with the technology sector earnings outlook remained robust. However, market optimism for the AI technology sector is lesser. Therefore, while US exceptionalism is reinforced by Trump 2.0 policies, equity market performance is expected to cover broader sectors, instead of the concentrated sector performance of 2024.

Meanwhile, China’s economic activity, while seeming to bottom out, has yet to exhibit strong recovery as consumer spending remains weak. From China’s National People’s Congress starting in early March, the market expects announcements on fiscal stimulus measures and budget deficit details to boost consumer spending, increase market liquidity and battle deflation to achieve the policy growth target of 5%. With US tariffs in the backdrop, the market expects China policymakers to provide more fiscal stimulus, given the Chinese government reiterated its objective to employ an aggressive stance to uplift growth.

For Malaysia, economic fundamentals remain stable. 4Q 2024 GDP growth reported at 5%, resulting in 2024 economic growth recording 5.1%. 2025 economic growth is expected to deliver within the government forecast of 4.8-5.5% as growth momentum likely sustained by domestic expenditure and investment activity. Jan inflation reported at 1.7% reinforces that inflation upside risk is likely to remain controlled, and that BNM will likely maintain the policy rate at 3% in the March meeting.

The encouraging bond market performance and drivers to date support our positive outlook on the local bond market, with bonds likely to gain 4 - 5% in 2025. Despite higher yield risks due to inflationary pressures both locally and globally, the downside risk to the bond market is limited. The upside risk to yields is expected to be mitigated by reasonable bond valuation, lower government bond supply, and ample liquidity in the system. Besides, BNM is likely to hold the policy rates unchanged at 3% in 2025 to maintain real rates.

Despite negative equity performance to date, we continue to be positive on local equity. Local equity is expected to outperform global equity amidst global economic moderation and uncertainties from Trump's policy agenda. Local market resilience is supported by expected sustainable economic growth and appealing market valuations with earnings yields of 6% - 7% and a 4% dividend yield. Besides, Malaysia may benefit from trade diversions due to US tariff risks, and from China's economic momentum. Further potential equity upside could come from a weaker USD, attracting foreign inflows given low foreign shareholding in local equity markets (~20%). However, market volatility persists due to global trade uncertainties.

Given our more positive outlook on the local equity market, including Asia and the bond market, we prefer the PRULink Managed 2 Fund and PRULink Managed Plus Fund for investment diversification; the PRULink Equity Plus and PRULink Equity Income for Malaysia exposure; and the PRULink Asia Great Fund, PRULink Asia Equity Fund and PRULink Asia Managed Fund for Asia exposure.

Note: 3rd March 2025

Written by Esther Ong

Esther Ong is the Investment Market Strategist of Prudential Assurance Malaysia Berhad (PAMB).Esther is a qualified Chartered Financial Analyst as well as having obtained MSc Investment Management and BSc Insurance & Investment with a Financial Markets Association of Malaysia (Persatuan Pasaran Kewangan Malaysia or PPKM) license.

This feature is to provide general information on the current situation of the economy with the information available at the given time. This feature does not constitute investment advice and cannot be used or substituted as such. The opinions of the author may not necessarily reflect the views of Prudential Assurance Malaysia Berhad.