Mixed Global Performance, Strong Ringgit and China Gains?

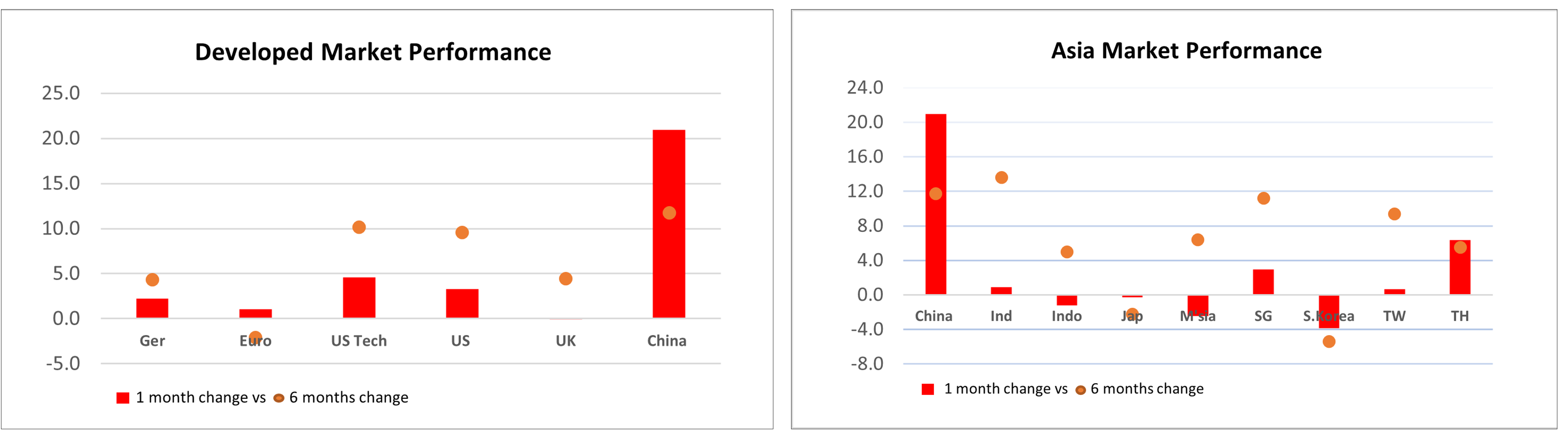

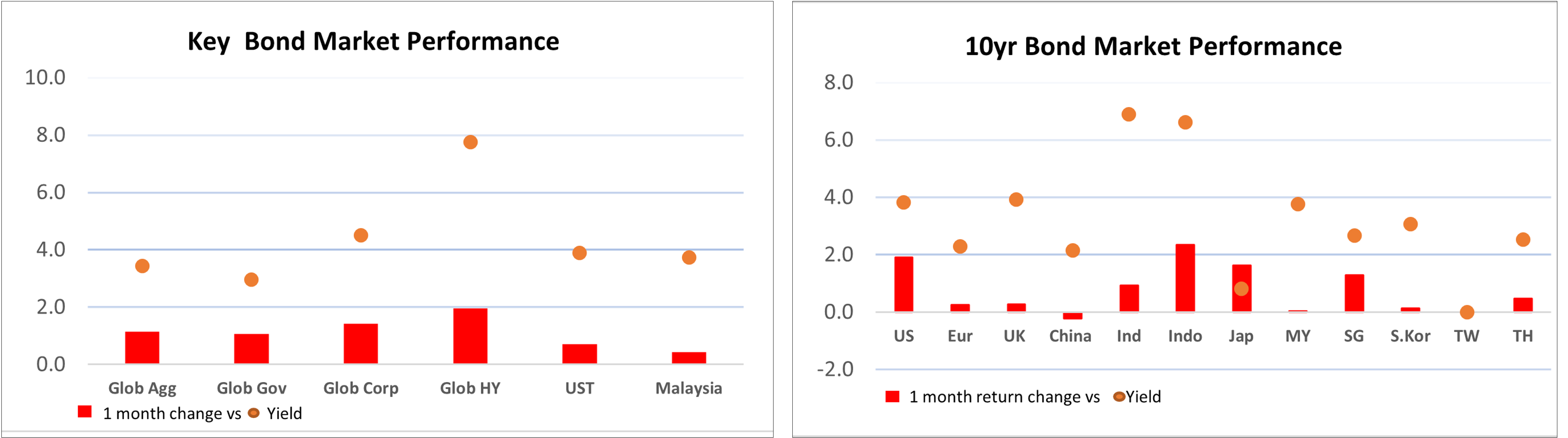

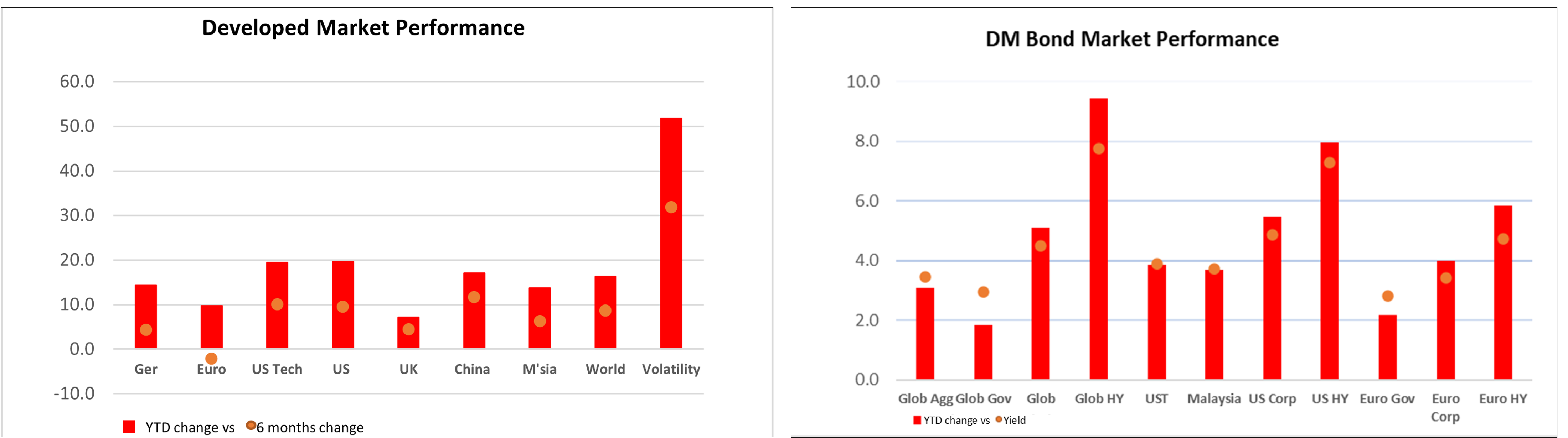

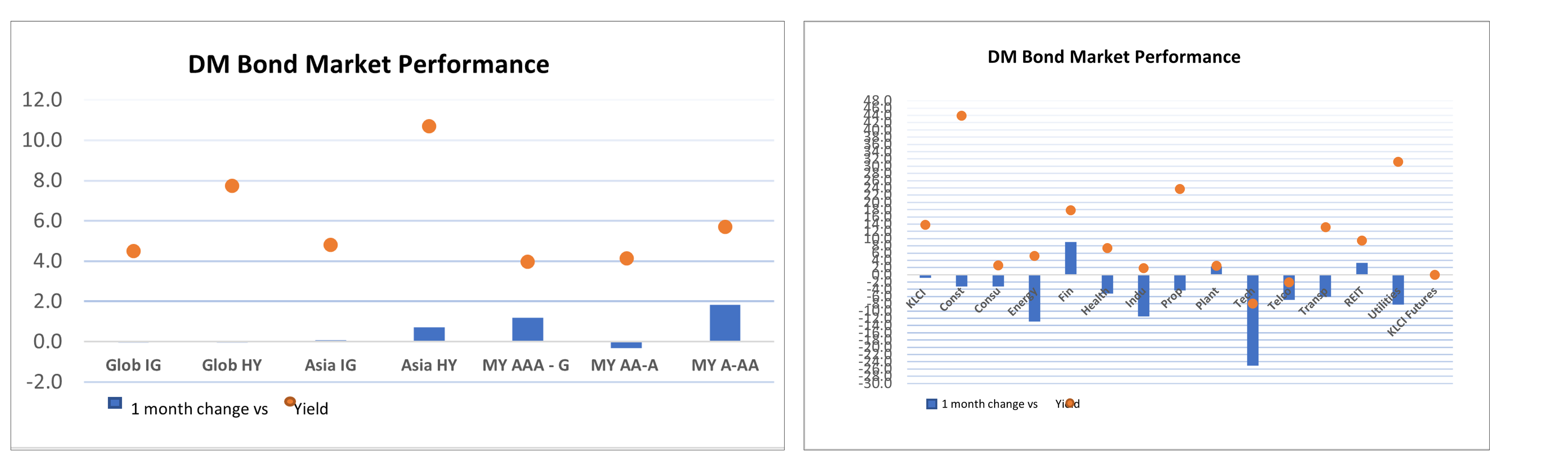

Post a strong equity market performance in August, the month of September exhibited a rather mixed performance globally. Significant positive movement was observed in Ringgit and China equities. For equities, while global equities (in USD) were up a strong +2.17% MoM (“Month-on-Month”) to 16.30% YTD (“Year to Date”), local equity retreated -1.78% MoM. Overall, when measured in Ringgit, local equities did better, up +13.35% YTD compared to global equity (in MYR) +5.27% YTD as Ringgit strengthened almost 9% YTD (global equity +16.30% YTD in USD). Meanwhile, bonds were up marginally in line with the US rate cut and holdings yields. Global bonds and local bonds were up +1.1% MoM and +0.44% MoM, resulting in 3.09% YTD and 3.69% YTD respectively. The star equity market performer - China equity, climbed +20.97% MoM, bringing to +17.10% YTD.

There were a few key government policy initiatives that triggered such market movement. In the US, the US Federal Reserve (“Fed”) in its 17th/18th Sept 2024 meeting, decided to cut the Fed Funds Target Rate (FFTR) by 50 bps to a range of 4.75% - 5.00%. The cut was deeper than market expectations of 25bps. Given the Fed’s dual mandate, Fed pivoted toward focusing more on addressing the dampening job market as the US inflation situation is improving towards the 2% inflation target. Nevertheless, Fed warned that the 50bps cut is not the new pace and guided another 50bps cut in 2024 to 4.25% - 4.50% and 100bps cut in 2025 to 3.25% - 3.5%. With the rate cut trajectory, market risk appetite improved although both the current US & Euro economic backdrop suggests slowing economic momentum. The rate cut trajectory is expected to ease the growth to a soft landing instead of a hard landing.

Meanwhile, China’s economy growth is still weighed down by poor manufacturing activity and weak consumer consumption amid still falling property market. Having announced several measures earlier with no material positive impact, the government surprised the market with two key announcements in September. First, the PBOC Governor announced a comprehensive package of easy monetary policy and mortgage policy measures, as well as liquidity support that exceeded market expectations. Secondly, the off-cycle Politburo on 26th September gave the strongest signal to uplift the economy with its new pledge to halt the property market decline and indication to ramp up government fiscal spending. Such is deemed a major move by the government to reflate the economy. With foreign investments in the China equity market being at low levels, some repositioning into China equities and short covering provided a significant boost to the market.

On the local front, Malaysia’s fundamentals continued to gain positive momentum. Malaysia’s July industrial production and manufacturing activity gained pace, and the investment commitment outlook remained attainable. The government continued its active implementation of the national master plan and business-friendly policies. To realise Johor’s goal to become a developed state by 2030 and the Johor Singapore Special Economic Zone, a package of incentives including special tax rate was launched for the Johor’s Forest City as the Special Financial Zone. With the improvement in trade activity and robust domestic demand, Malaysia’s growth momentum will sustain to achieve the 5% - 5.5% growth target.

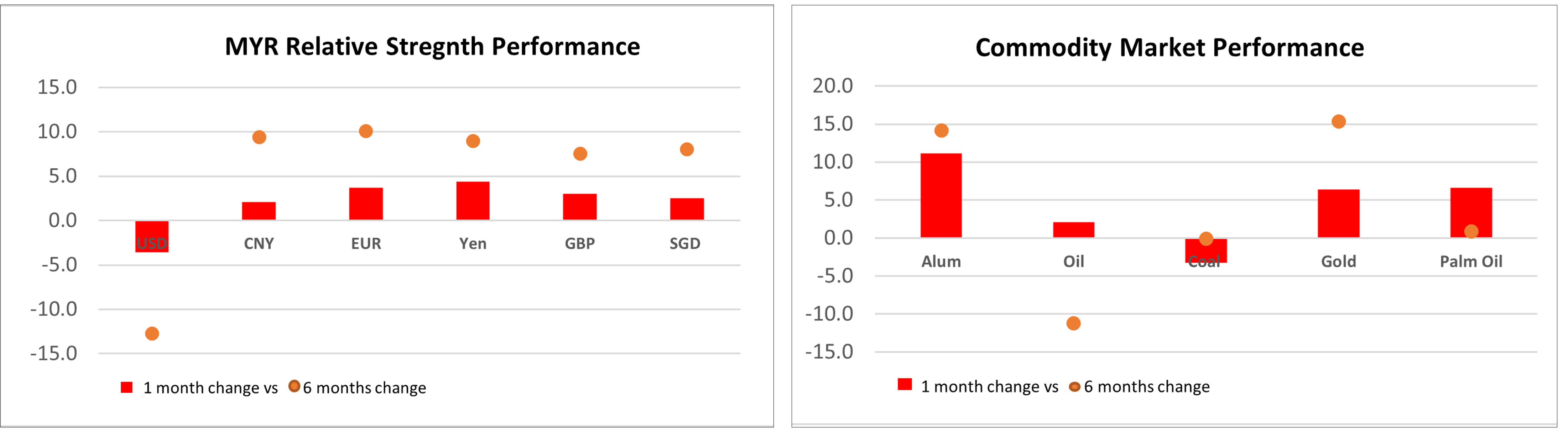

Bank Negara Malaysia (BNM) continued to keep the overnight policy rate (OPR) steady at 3.00% in September, the eight straight month of unchanged rate hike. BNM is likely to keep OPR unchanged in the near term given the positive economic growth momentum and lingering upside risks to inflation pending further subsidy rationalisation measures. Nevertheless, Malaysia’s inflation reported to date remained low. August headline inflation reported lower at 1.9% (July 2%) due to lower services cost. As such, coupled with the US rate cut trajectory and China resilient Yuan following positive economic prospects, Ringgit could remain strong. Ringgit is the best performing currency in Asia up +12.75% over the 6 months period, while Singapore dollar is up +4.05%, Japan Yen +3.47%, and China Yuan +3.02%.

Therefore, given Malaysia’s economic growth prospects remain intact with likely potential upside, overall, we continue to advocate our positive view on the Malaysian equity and bond market. The undemanding equity market valuation, stronger MYR prospect amid low foreign shareholding, and China recovery prospect should drive the Malaysian equity market higher. The bond market, capped by stable policy rate, will remain a good asset diversifier from risky assets while yielding stable returns. Meanwhile, we continue to accumulate global equity market on weakness as while risky assets remains supported by global central banks’ rate cut direction, the equity market will remain volatile due to diverging and uneven global economic paths. There are market opportunities as market performers have yet to broaden out to the broad economy from the high concentrated performers related to the technology-related sectors.

Given our more positive outlook on the local equity market, including Asia and the bond market, we prefer the PRULink Managed 2 Fund and PRULink Managed Plus Fund for investment diversification; the PRULink Equity Plus and PRULink Equity income for Malaysia exposure; and PRULink Asia Great Fund, PRULink Asia Equity Fund and PRULink Asia Managed Fund for Asia exposure.

*Return is as of 10/2/2024

Written by Esther Ong

Esther Ong is the Investment Market Strategist of Prudential Assurance Malaysia Berhad (PAMB).Esther is a qualified Chartered Financial Analyst as well as having obtained MSc Investment Management and BSc Insurance & Investment with a Financial Markets Association of Malaysia (Persatuan Pasaran Kewangan Malaysia or PPKM) license.

This feature is to provide general information on the current situation of the economy with the information available at the given time. This feature does not constitute investment advice and cannot be used or substituted as such. The opinions of the author may not necessarily reflect the views of Prudential Assurance Malaysia Berhad.