Global equity gains amidst mixed Asia Pacific performance

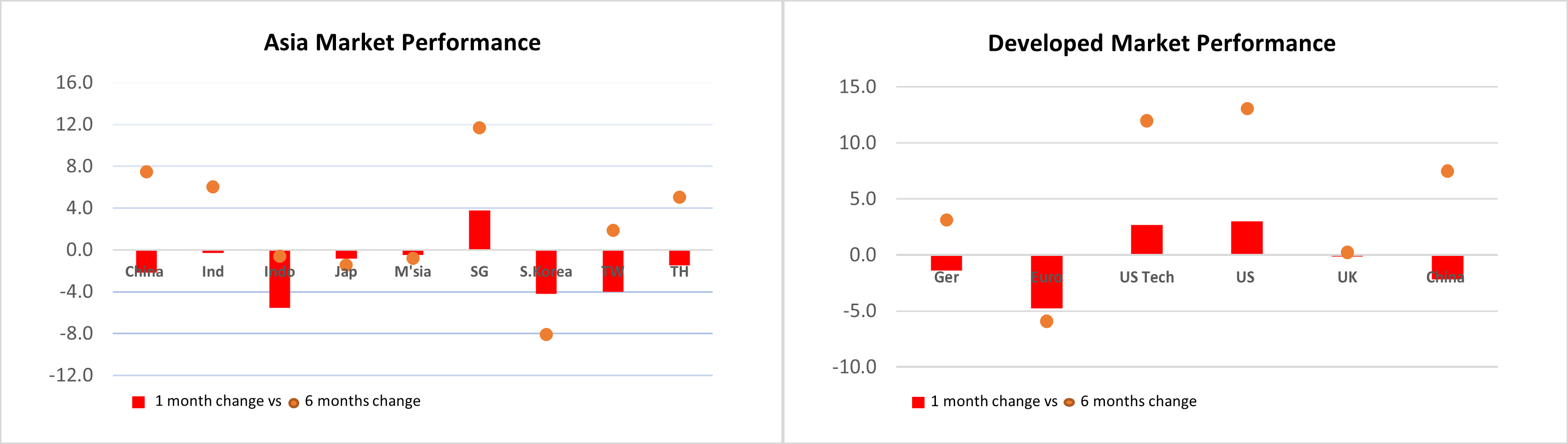

The global equity market, including Malaysia, ended 2024 on a strong note (global equity up +15.7%, Malaysia up +12.9%). However, while the global bond market was dismal, Malaysia’s bond market garnered decent return (Malaysia bonds up +4.3%, global bonds down marginally -1.7%). As we enter 2025, the global equity market continued to gain but with mixed performance in the Asia Pacific region (Jan: global equity up +3.8%, Asia equity flat +0.7%). The Malaysia equity market posted negative return, likewise with China and Thailand. (Jan: Malaysia equity down -4.2%, China -2.6%). Meanwhile, global bond market continued to be dismal and volatile although of a lesser drag, and Malaysia bond market remained stable (Jan +0.45%).

The overall equity and bond market performance shown was on the back of four main counts. Firstly, the global economy growth remains resilient with the US economy exhibited expansionary growth and healthy labour demand. Therefore US exceptionalism, further reinforced by Trump 2.0 policies, remains supportive of US exceptional market strength despite demanding valuation. Secondly, US Federal Reserve has lowered the number of rate cuts in 2025 to 2x from 4x previously (Fed target rate down to 4%) due to higher inflationary expectations and resilient economy. The higher for longer US rates led to bearish bond market sentiment and stronger USD or weaker Ringgit given cautious investment positioning. Fourthly, China’s economic growth momentum has bottomed in 4Q 2024, lifting the 2024 growth to end at 5%. The improvement was due to the various fiscal and monetary policy stimulus measures introduced to improve liquidity, boost consumer spending, and stabilise the property market. China’s government reiterated its objective to employ aggressive stance to uplift growth. Nevertheless, market confidence remains weak as the details on fiscal deficit commitments are yet to be announced, which if any are likely in March 2025.

Meanwhile, on the local front, Malaysia’s economic fundamentals and banking industry remained positive. Malaysia’s advance 4Q economic growth estimate remained robust at 4.8% though slower from 5.3% in 3Q, bringing 2024 growth to 5.1%. Besides, BNM kept policy rate at 3% in Jan 2025 citing robust growth of 4.5% - 5.5% expected in 2025, underpinned by investment and consumer spending growth despite downside risk from external trades and heightened policy uncertainty. While inflation is likely to inch higher, it will likely remain benign at 2.5-3.5% given the expected gradual implementation of subsidies reform. However, the recent US’ artificial intelligence (AI) chip export restrictions with Malaysia classified as a Tier 2 country triggered significant decline across domestic hyperscale data centre (DC) related equities, such as some in the construction and utilities sector.

Our outlook on local bond market has turned positive with bonds likely gain 4 - 5% in 2025. Despite higher yields risk due to inflationary pressures, both locally and globally, the downside risk to the bond market is limited. The upside risk to yields is expected to be mitigated by reasonable bond valuation, lower government bond supply, and ample liquidity in the system. Besides, BNM is likely to hold the policy rates unchanged at 3% in 2025 to maintain real rates.

We continue to be positive on local equity. Local equity is expected to outperform global equity amidst global economic moderation and uncertainties from Trump's policy agenda. Local market resilience is supported by expected sustainable economic growth (4.5R - 5.5%), higher corporate earnings growth (5-10%), a stable political landscape, and appealing market valuations with earnings yields of 6% - 7% and a 4% dividend yield. The sustainable economic growth is driven by rising domestic and foreign investments supporting various government initiatives. Besides, Malaysia may benefit from trade diversions due to US tariff risks, serving as a China Plus One manufacturing hub and from China's economic momentum. Further potential equity upside could come from a weaker USD, attracting foreign inflows given low foreign shareholding in local equity markets (~20%). However, market volatility persists due to global trade uncertainties.

Given our more positive outlook on the local equity market, including Asia and the bond market, we prefer the PRULink Managed 2 Fund and PRULink Managed Plus Fund for investment diversification; the PRULink Equity Plus and PRULink Equity Income for Malaysia exposure; and the PRULink Asia Great Fund, PRULink Asia Equity Fund and PRULink Asia Managed Fund for Asia exposure.

Written by Esther Ong

Esther Ong is the Investment Market Strategist of Prudential Assurance Malaysia Berhad (PAMB).Esther is a qualified Chartered Financial Analyst as well as having obtained MSc Investment Management and BSc Insurance & Investment with a Financial Markets Association of Malaysia (Persatuan Pasaran Kewangan Malaysia or PPKM) license.

This feature is to provide general information on the current situation of the economy with the information available at the given time. This feature does not constitute investment advice and cannot be used or substituted as such. The opinions of the author may not necessarily reflect the views of Prudential Assurance Malaysia Berhad.