Global and Malaysian Markets Recover Strongly After Early August Volatility

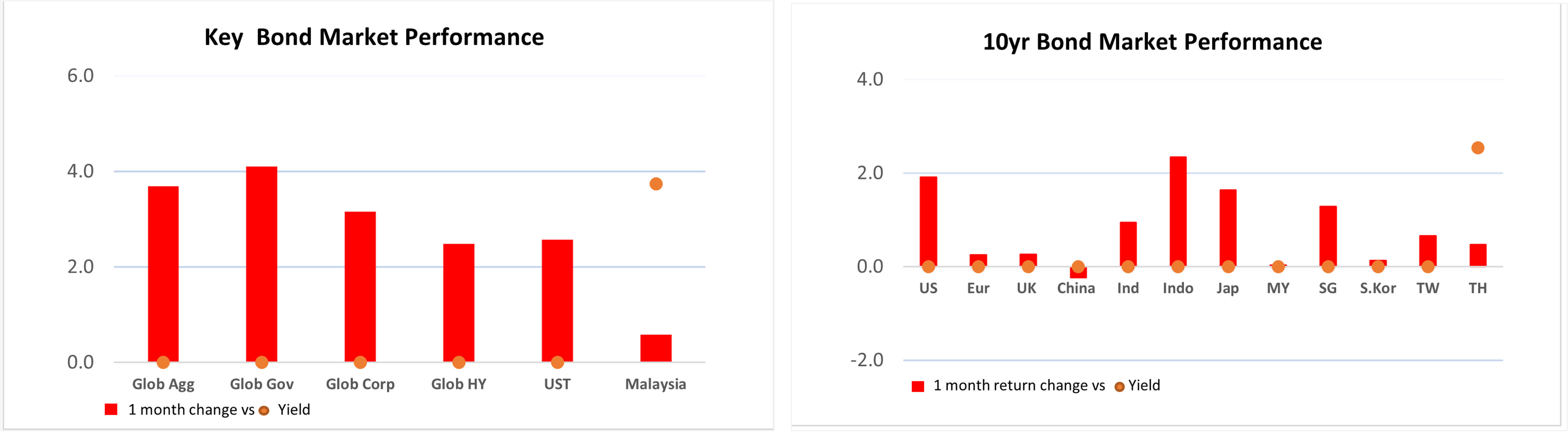

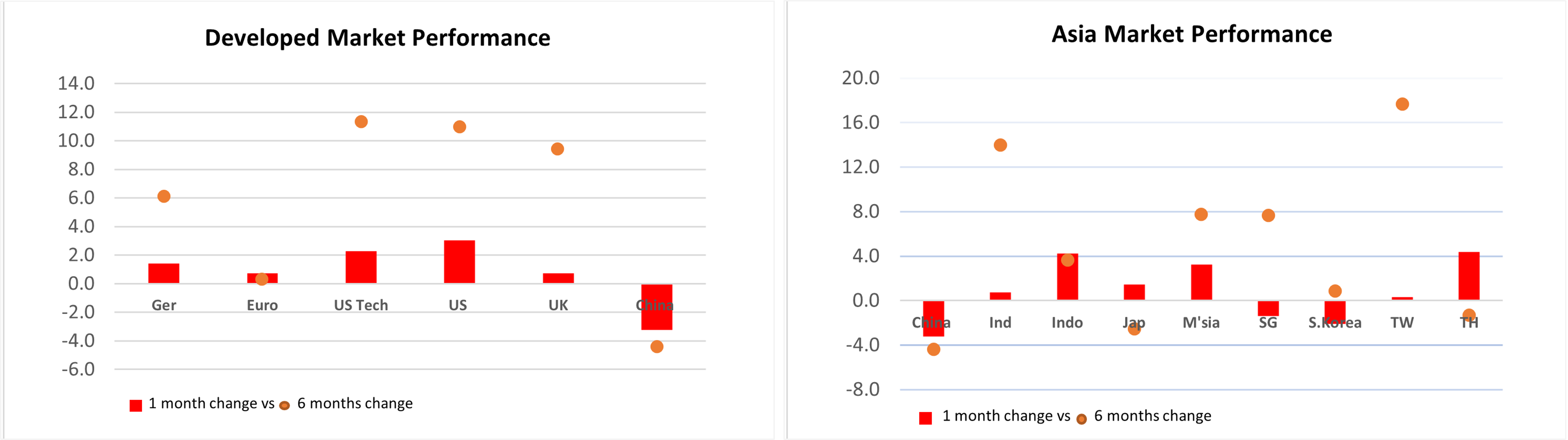

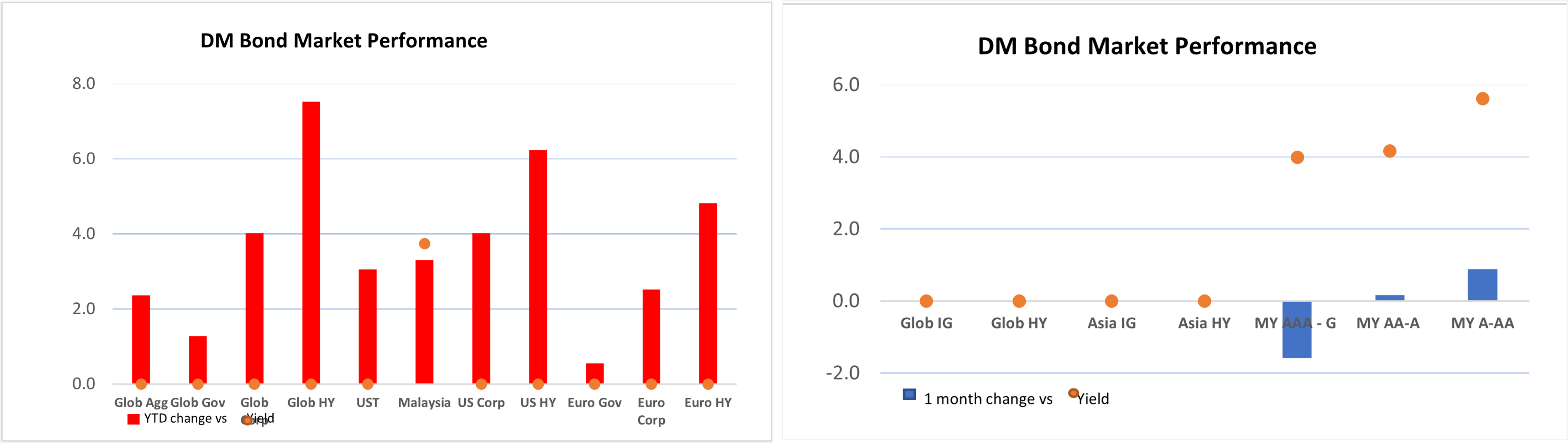

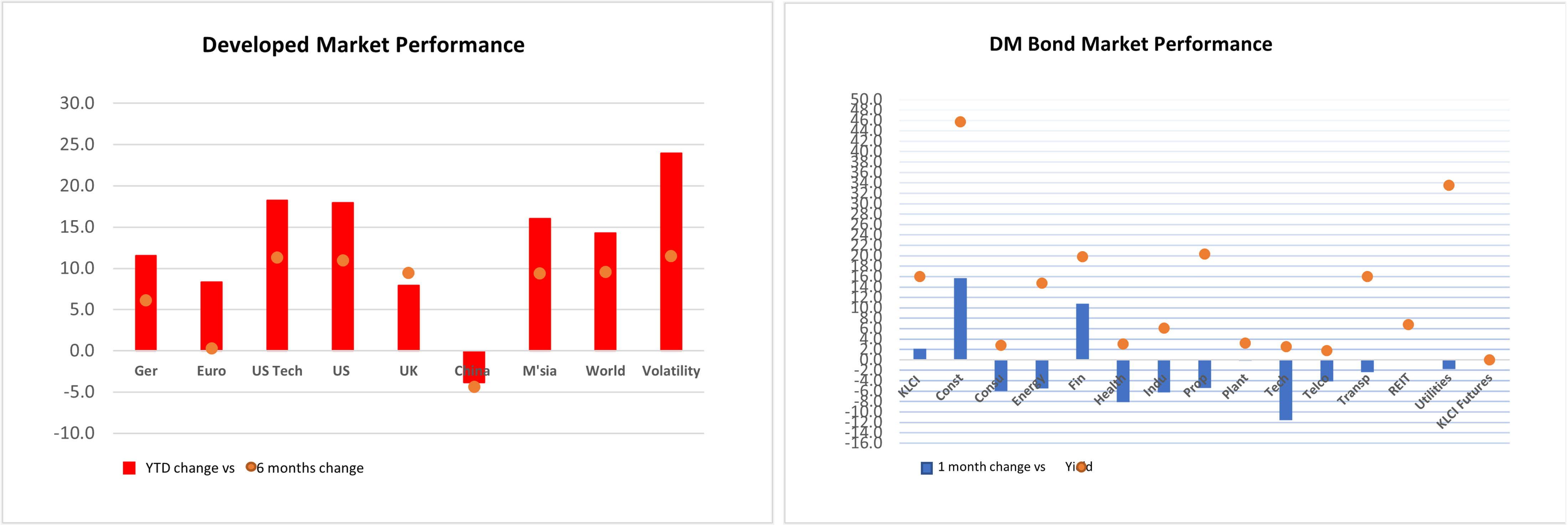

Global equity market, including Malaysia, had an unexpected violent swing during early August before swiftly recovering to positive territory towards the end of the month. Both the global equity and local equity market ended positively, with +3.4% Month-on-Month (MoM) and +3.2%(MoM) respectively, bringing the total return higher to 14.3% Year-to-Date (YTD) and 16.05% (YTD). Similarly, due to market risk aversion and higher growth risk, the bond market also surged higher, with both the global bond and local bond markets up +3.69% (MoM) and +0.58% (MoM) respectively, resulting in decent positive returns of 2.36% (YTD) and 3.30% (YTD). Nevertheless, the local market performance in general delivered better returns relative to global market YTD.

The violent swing in early August, while unexpected, was imminent as it was preceded by a general buildup of market cautiousness following a cumulative series of US data suggesting slower economic activity amid contracting manufacturing activity, weaker housing market, subdued consumer sentiment and softer job market. Despite the encouraging disinflationary trend, it was the surprisingly soft July employment report that pivoted the cautious market into a deep dive, with global equity market and local equity down -1.8% and -2.09% respectively in early August (from July month end till 9/8/24).

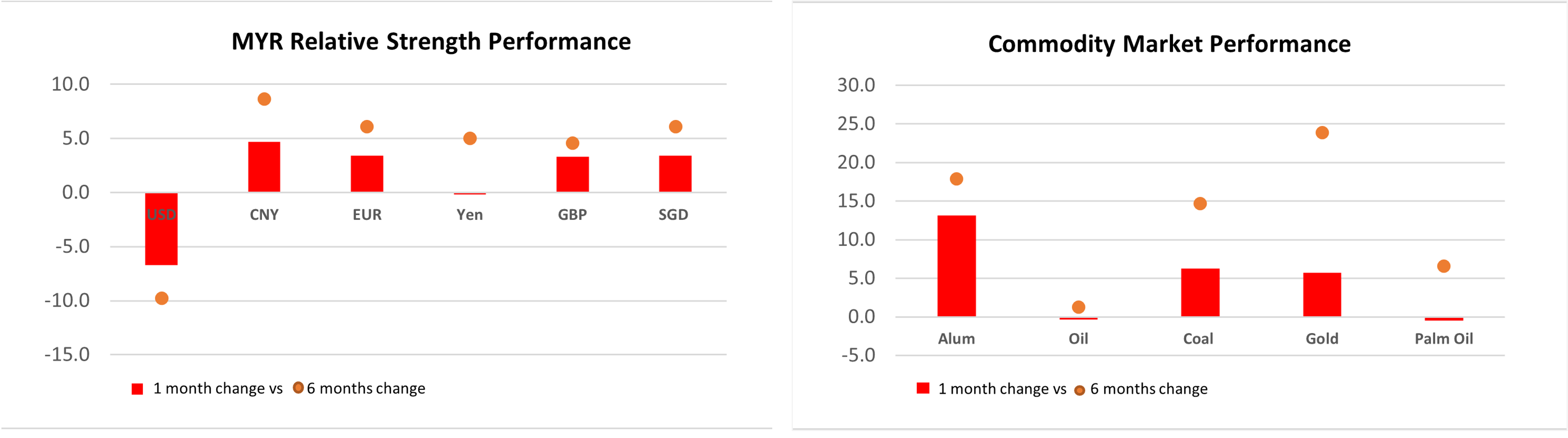

The market then pivoted from a soft-landing prospect to a hard landing and/or recession prospect, from US rate cut expectations of 2-3x to 5-6x. The drastic pivot indicated the vulnerability of the market, as the market had been riding high on a resilient economic and corporate earnings environment amid lower interest rate prospects. Meanwhile, consequent to the higher US rate cut expectations coupled with Japan’s unexpected shift to hawkish rate hike guidance, the USD weakened sharply against the Yen by about 10%. The latter unwinding also contributed to the violent market swing given the earlier heavily positioning of Yen carry trade. Likewise, the MYR also appreciated in tandem by about 7%.

Similarly, the Eurozone’s growth prospect remained subdued as weakness persisted in Germany, and the overall price pressures were also on balance weaker. Meanwhile, China’s economic activity, although in the expansionary phase, generally continued to come in on the soft side since 1Q 2024, notably slowing exports, weakening fixed asset investment growth, falling loan growth and ongoing housing drag, while retail sales picked up moderately. However, market optimism improved as China cut rates unexpectedly following weaker-than-expected economic data threatening the 5% growth target and the confirmation of US rate cut direction. Nevertheless, market excitement quickly turned neutral when no further stimulus was announced following the July Politburo meeting, although the government reiterated its focus on implementing the stimulus and boosting consumption spending.

On the local front, Malaysia’s fundamentals remain strong, supporting market optimism. 2Q GDP is estimated to be higher than expected at 6%, June industrial production growth higher at 5%, and loan growth advanced further to 6.4%, notably stemming from corporate front. Amid the economic strength and the withdrawal of various selective subsidies, local inflation remained surprisingly well-anchored at 2% in July. Thus, given further subsidy rationalisation and salary hikes for civil servants flagging potential upside risks to future inflation, BNM is likely to keep current policy rate at 3% despite other global central banks headlining into a rate cut direction.

Therefore, given Malaysia’s economic growth prospects remain intact with likely potential upside, overall, we continue to advocate our positive view on the Malaysian equity and bond market. The undemanding equity market valuation, stronger MYR prospect amid low foreign shareholding and China recovery prospect should drive the Malaysian equity market higher. The bond market, capped by a stable policy rate, will remain a good asset diversifier from risky assets while yielding stable returns. Meanwhile, we continue to accumulate global equity markets on weakness as, while risky assets remain supported by global central banks’ rate cut direction, the equity market will remain volatile due to diverging and uneven global economic paths, while market performance has yet to broaden out to the broad economy from the high concentrated performers related to the technology-related sectors.

Given our more positive outlook on the local equity market, including Asia and the bond market, we prefer the PRULink Managed 2 Fund and PRULink Managed Plus Fund for investment diversification; the PRULink Equity Plus and PRULink Equity income for Malaysia exposure; and the Asia Growth Fund, PRULink Asia Equity Fund and PRULink Asia Managed Fund for Asia exposure.

*Return is as of 27/8/2024

Written by Esther Ong

Esther Ong is the Investment Market Strategist of Prudential Assurance Malaysia Berhad (PAMB).Esther is a qualified Chartered Financial Analyst as well as having obtained MSc Investment Management and BSc Insurance & Investment with a Financial Markets Association of Malaysia (Persatuan Pasaran Kewangan Malaysia or PPKM) license.

This feature is to provide general information on the current situation of the economy with the information available at the given time. This feature does not constitute investment advice and cannot be used or substituted as such. The opinions of the author may not necessarily reflect the views of Prudential Assurance Malaysia Berhad.