Global and Local Equity Markets Insight Amid Changing Interest Rates

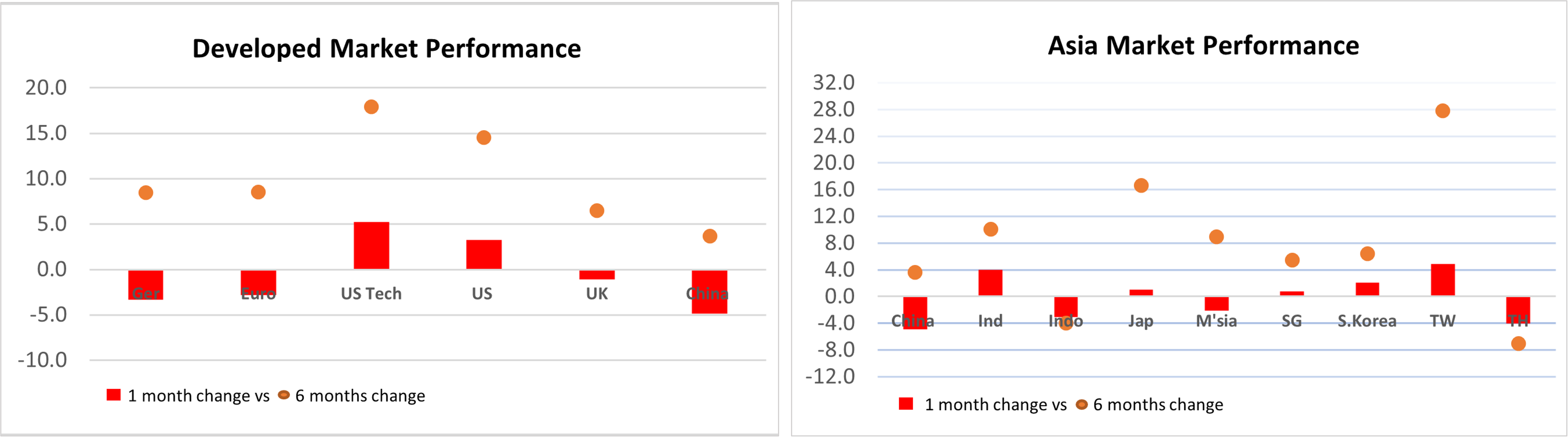

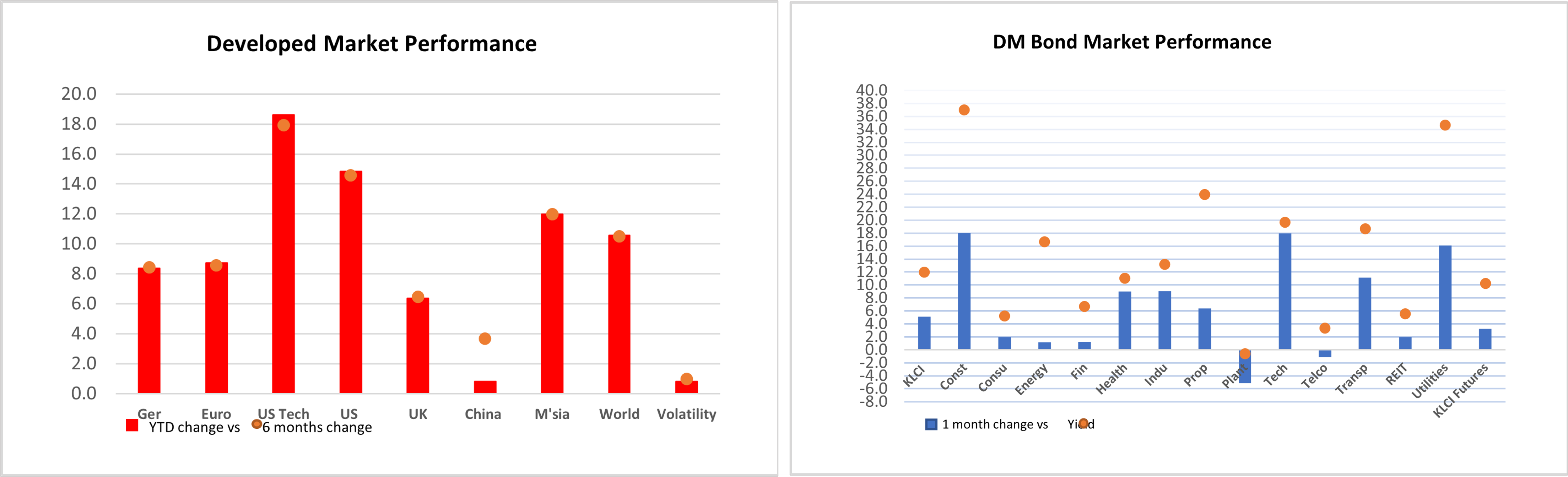

Equity markets globally turned mixed in June, resulting in a moderated global equity market performance with a +1.31% Month-on-Month (MoM) return. Likewise, the local equity market also eased, down -1.69% MoM. Nevertheless, Year-to-Date (YTD), equity markets’ performance largely remained strong with global equity markets, including local, recorded a double-digit return of 10.55% and 11.98% respectively. Such market consolidation observed in June is not unexpected, as highlighted in our last write up, as “higher for longer” US rates have further threatened the US positive “soft landing” narrative that has underpinned the global equity risk appetite. Besides, the unexpected call for a snap French legislative selection by President Macron at the end of June could weigh on Euro growth should there be any potential fallout. Nevertheless, current market consolidation is deemed healthy as allows for stronger market support for the market to climb further.

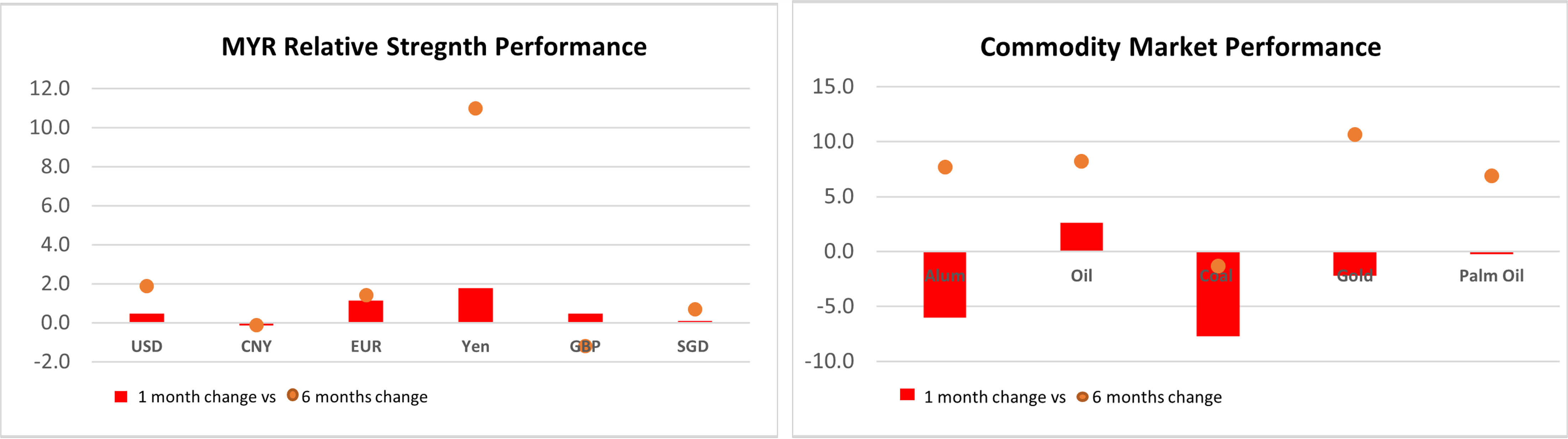

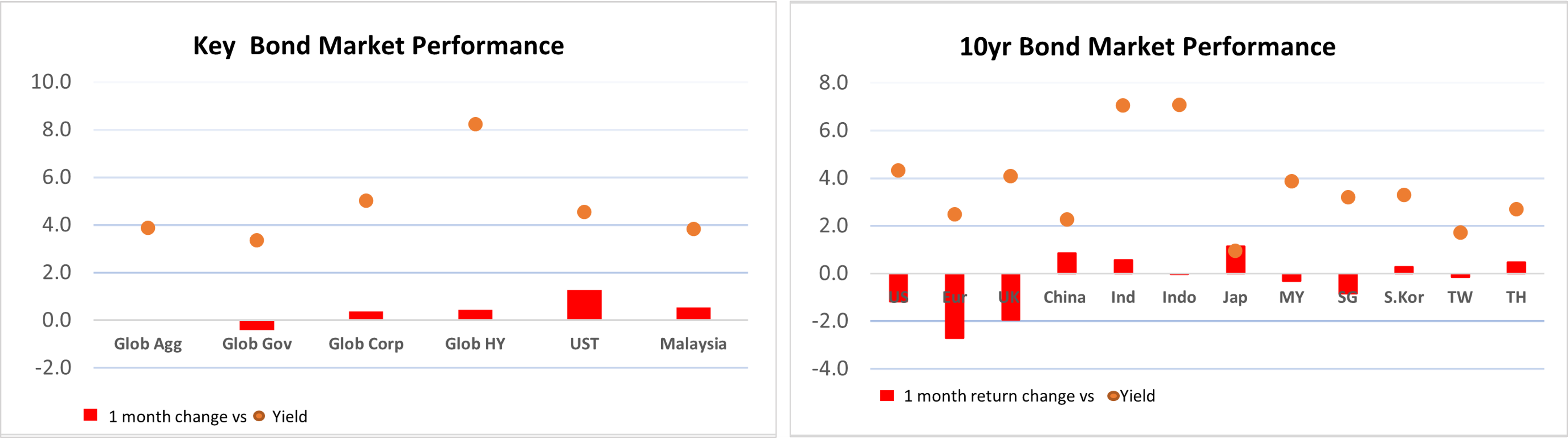

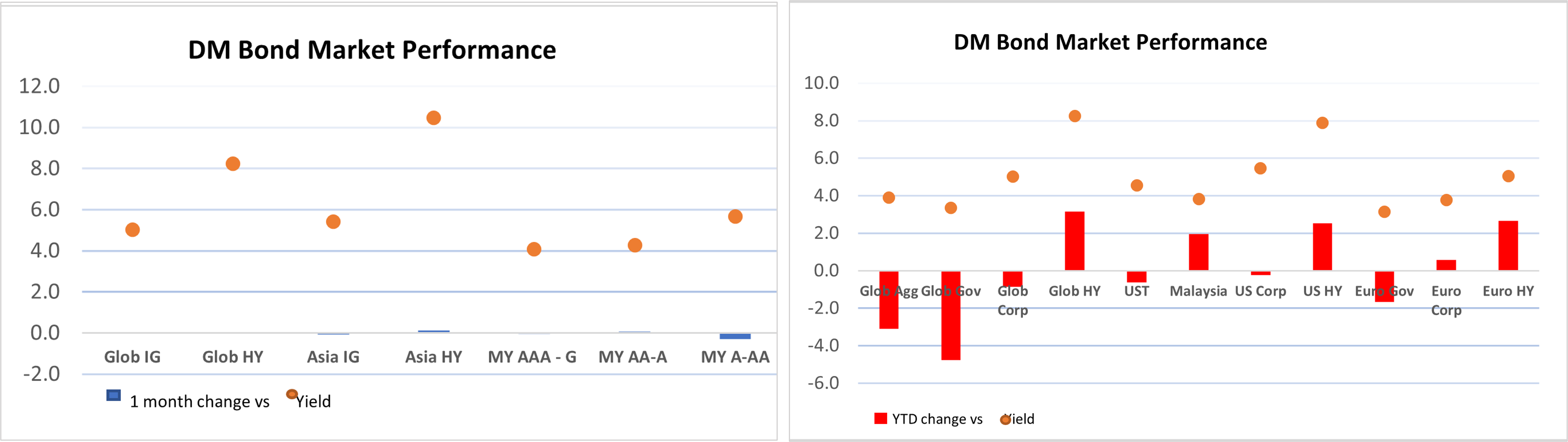

In short, the recent global equity market softness was largely driven by profit-taking due to lesser risk appetite following the lesser interest rate cut guidance in the developed markets. In June, the US Federal Reserve turned more hawkish with one rate cut guidance in 2024, and further rate cuts are datadependent. Likewise, the ECB also turned hawkish, though having done one rate cut in June. Despite the hawkish rate guidance and BNM likely keeping policy rate at 3%, bond markets generally turned better in June, underpinned by pockets of cooling economic data and lower US reported inflation. The local bond market performance improved +0.53% MoM to 1.96% YTD, outperforming the global bond market which up +0.1% MoM, narrowing losses YTD to -3.09%.

Against the backdrop of lower market risk appetite, the global economy fundamentally continued to run strong in May. Both the manufacturing and services sectors showed stronger expansion, while breadth among economies improved. US and Europe economy activity generally continued to show positive momentum despite some pockets of cooling. Meanwhile, the momentum of China’s economy activity, though remaining in recovery phase, continued to moderate since Q1 due to overhanging weak property market sentiment, supply risk and geopolitical trade war concerns. Overall, the main global growth risk is still sticky global prices leading to slower disinflation and thus resulting in “higher for longer” interest rates. A prolonged “higher for longer” interest rates would likely threaten the current economy growth, tilting it into a recessionary one.

Overall, having highlighted in May the possibility of global equities including Malaysia likely to consolidate in the near term, we expect the consolidation to continue for a while as the market digests the “higher for longer” interest rates landscape. Besides, the market will also need to watch if the positive economic data and disinflation trend remain on track, as well as if corporate earnings continue to deliver as expected or exceed expectations. The local market, having swamped with a series of positive themes, would likely need continuous news flow, supportive Budget 2025 measures and on-track earnings delivery progress for the next upward leg. Meanwhile, further upside could also stem from foreign capital inflows and any receding overhanging risk of China’s recovery pace.

Therefore, keeping our constructive preference for local equity market, including Asia, for better expected return relative to risk, we view any weakness in the current market consolidation as an investment opportunity to accumulate further. Meanwhile investment positioning in the local bond market remains for risk diversification and expected stable return. Given our more positive outlook on the local equity market including Asia and the bond market, we prefer the PRULink Managed 2 Fund and PRULink Managed Plus Fund for investment diversification; the PRULink Equity Plus and PRULink Equity income for Malaysia exposure; and the Asia Growth Fund, PRULink Asia Equity Fund and PRULink Asia Managed Fund for Asia exposure.

*Return is as of 26/6/2024

Written by Esther Ong

Esther Ong is the Investment Market Strategist of Prudential Assurance Malaysia Berhad (PAMB).Esther is a qualified Chartered Financial Analyst as well as having obtained MSc Investment Management and BSc Insurance & Investment with a Financial Markets Association of Malaysia (Persatuan Pasaran Kewangan Malaysia or PPKM) license.

This feature is to provide general information on the current situation of the economy with the information available at the given time. This feature does not constitute investment advice and cannot be used or substituted as such. The opinions of the author may not necessarily reflect the views of Prudential Assurance Malaysia Berhad.